What employment documents do I need to buy a home?

Your lender wants to see that you have consistent and stable employment or income before you can get a mortgage to buy a home. For self-employed individuals, or small business owners, providing documentation to prove your employment can be complicated. Lenders want a clear picture of each borrower's ability to pay back the loan and often want to see 2 or more years worth of tax returns that show consistent self-employment income. For most employees, however, proving employment can be done by providing recent pay stubs and W2s.

Some lenders want to see your hire date and current employment status. You can provide this information in a letter from your current employer. It can be helpful to provide your employer's contact information, including business name, address, and HR representative's name and phone number when you apply for your loan.

What tax records should I gather?

Your W2s are considered part of your tax records, and most mortgage providers want to see them. Buying a home can be trickier if you are self-employed, a small business owner, or earn income from a non-traditional source. Most of the time, your lender wants to see at least two years of tax records to prove that your business or self-employment is valid and profitable. Lenders rely on this information as proof you are gainfully employed and can afford to pay your mortgage.

If you had a sudden change in employment or income, you may be asked to submit additional years of tax returns. You can contact your lender to explain the situation, then determine what additional documentation they require. If you have questions about discussing your self-employment or small business income with a lender, reach out to a Rocket Lawyer network attorney for affordable legal advice.

What financial documents do I need to show the lender to buy a home?

The lender will access your credit score to examine your debt-to-income ratio and overall credit history. If you have outstanding loans, you may be asked to show documentation, which might be in the form of statements with account balances. Gather the names, addresses, account numbers, monthly payment amounts and outstanding balances of each account, if you can, into one document to make it easy for your lender to review the information all in one place.

Lenders also like to see information about assets. This starts with your bank statements, and includes 30 to 60 days of transactions. If you have a business, year-to-date profit and loss statements are helpful.

All of your assets count toward your home buying power. If you own another property, have IRAs, stocks, bonds, CDs, or other securities, bring statements showing their value. If you have money for a down payment, then demonstrate this through your bank statement. Any additional income, like disability payments or dividends, also need to be part of your financial information packet.

What real estate or residential history documentation do I need?

Make a list that includes your home addresses and landlords' names and contact information if you rented for the past two years. If you are a homeowner, you will be asked to provide proof of home ownership or proof of sale. If you own non-residential property that is considered an asset, you will need to provide proof of ownership. You can show ownership of a property with a deed or property title listing you as the legal owner.

Buy Confidently With Rocket Lawyer

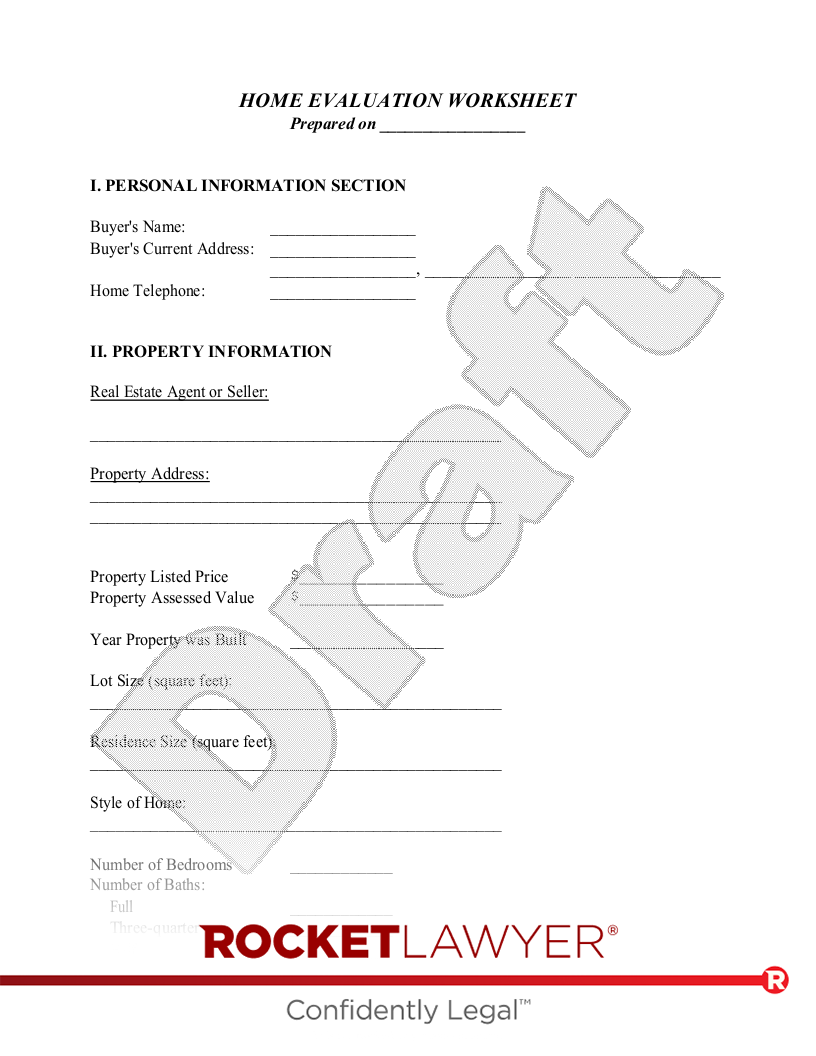

Buying a home is a major investment. Rocket Lawyer can help you navigate the process with customizable Real Estate and Home Ownership Documents and professional legal advice. Start with the Home Evaluation Worksheet to compare your options, then use the Intent to Purchase Real Estate letter to write down the negotiated terms for your offer. After you complete the sale, use the Moving Checklist to ensure you have everything lined up to move into your new home. If you run into legal problems along the way, reach out to a Rocket Lawyer network attorney, or download the Rocket Lawyer mobile app to get all the legal help you need, anytime, anywhere.

This article contains general legal information and does not contain legal advice. Rocket Lawyer is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.