Can I use my 401(k) to buy a house?

Generally, you can use funds from your 401(k) to buy a house. Whether it is a good idea depends on your financial situation as there are drawbacks.

A 401(k) is a type of retirement savings account that is designed to help you prepare for retirement. When you add money to your 401(k), you get a tax deduction, which means that money is not taxed. The investments in your 401(k) also grow without being taxed each year. Instead of being taxed when you earn the money or as your investments gain value, the money you add and the value your 401(k) gains are taxed when you withdraw from the account. In exchange for these tax benefits, the IRS puts strict rules on when you can take funds from your 401(k).

Nevertheless, because a 401(k) is often a person's largest financial account, people often explore whether they can use some of its funds to buy or make a down payment on a home. While possible, there are, however, a few important things to consider before touching your 401(k).

For starters, getting money out of the account requires either taking a withdrawal or taking a loan from your 401(k). In most cases, a 401(k) loan may be available with your 401(k) plan, and it may be a better option than a withdrawal.

What is the difference between a 401(k) loan and a 401(k) withdrawal?

When you withdraw money from your 401(k), you have to pay income taxes on the amount you withdraw and you may also have to pay a 10% early withdrawal penalty if you are not at least 59½ years of age. Unlike a 401(k) loan, you do not have to repay a 401(k) withdrawal, which can make this type of funding sound good to first-time homebuyers. Remember, though, the money you withdraw will no longer be there for you at retirement.

If your 401(k) is the only funding source you have, then you might consider buying your home using a 401(k) loan instead of a 401(k) withdrawal. Before considering this option, however, remember to check to see if your 401(k) plan allows for a loan. These often allow you to borrow up to half the value of your vested balance, and repay yourself, with interest. While most 401(k) loans require repayment within 5 years, for some first-time homebuyers, that period may be extended.

What are the drawbacks to using a 401(k) to buy a house?

When using a 401(k) to buy house, the drawbacks vary based on whether a loan or withdrawal is used.

If you take out a 401(k) loan, you generally cannot add more money to your 401(k) while the loan is unpaid. That means you could miss out on the chance to add more tax-free money to your retirement account. For employer sponsored plans, you may also lose out on any employer matching until your loan is repaid. Additionally, be sure to read the fine print. If you leave your job or get laid off, you may have to repay the loan in full by that year's tax filing deadline. For example, if you take out a 401(k) loan on August 1, 2022, then leave your job on November 1, 2022, your 401(k) loan likely has to be repaid in full by April 15, 2023. If you cannot fully repay the loan by the due date, you may have to pay income tax on the unpaid portion, plus a 10% penalty.

When it comes to a 401(k) withdrawal to buy a home, you pay taxes on the withdrawal and also might have to pay a 10% early withdrawal penalty. You may want to withdraw much more than what you need for the down payment to pay the income taxes and penalties on the withdrawal. For example, suppose you want to add $60,000 to your down payment from your 401(k). You may need to withdraw $85,000 or more from your 401(k) to have enough to do so and to pay the taxes and penalties on the withdrawal.

Another drawback to taking a 401(k) withdrawal involves lowering the amount in your retirement account. That means you may have less to retire on than you planned.

Although there are drawbacks, sometimes a 401(k) loan or withdrawal is the best way to come up with the down payment for a home. Before deciding to dip into your 401(k), you might want to talk to a Rocket Lawyer network attorney or financial advisor to see if this is the best option for you.

Can I use my IRA to buy a house?

Yes. If you have been utilizing an IRA, withdrawing funds from an IRA can often be better than withdrawing funds from a 401(k).

If you have not owned a home that you have lived in within the past two years, special IRA rules may allow you to avoid the 10% early withdrawal penalty. Under these rules, a person who has not owned a home that they have lived in during the prior two years may withdraw up to $10,000 from their IRA without having to pay the 10% early withdrawal penalty. The withdrawal still requires you to pay federal and state income taxes, though. If you have a Roth IRA, you may be able to take a hardship withdrawal that is tax-free.

What are other options besides using my 401(k) to buy a house?

There are a few home-buying options besides a traditional bank loan that you might think about before pulling funds out of your 401(k). Low-down-payment home loans are usually a good place to begin exploring. FHA loans are a popular choice for first-time homebuyers. FHA loans are backed by the federal government and typically require a down payment of 3.5%. You may be able to find similar first-time homebuyer programs sponsored by your state, county, or city. Veterans and service members may be able to take out VA loans with no down payment. If you are buying a home in a rural area, you may be able to use a USDA loan, which may require no down payment.

Other options include asking close friends or family members if they are willing to help you with a personal loan for the down payment.

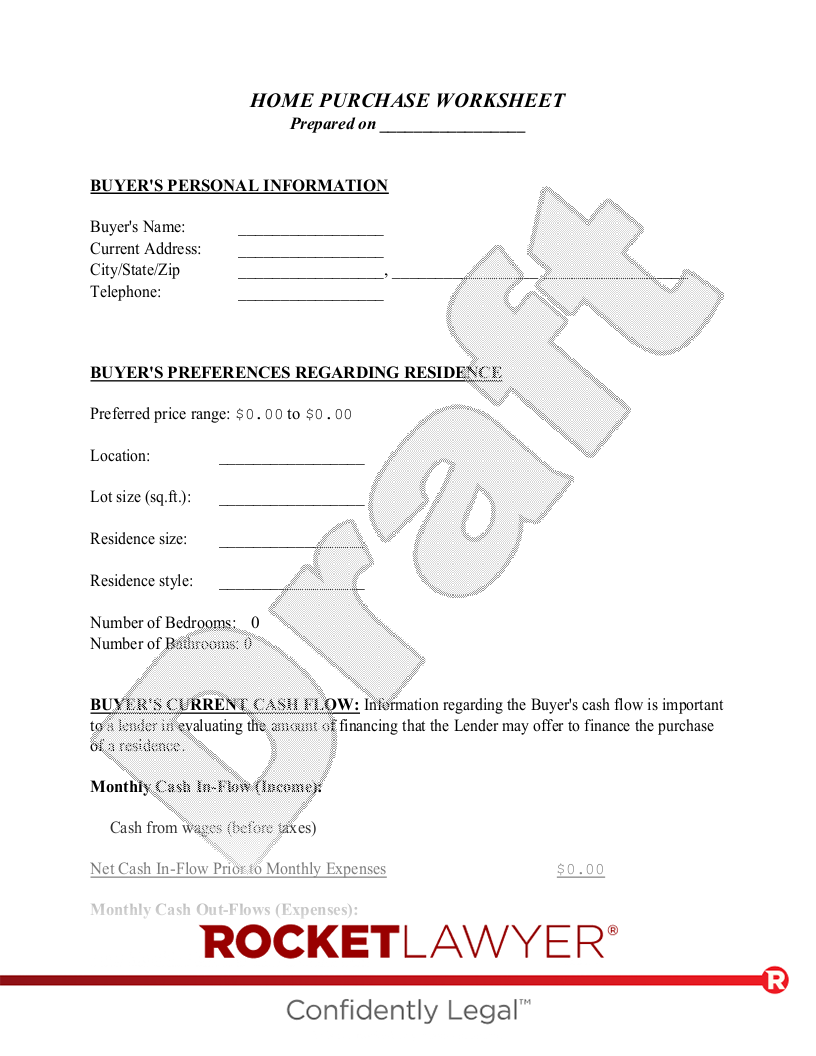

Deciding how to fund your down payment is just one step in buying a home. A Home Purchase Worksheet can help you work out the details. If you have more questions about using your 401(k) to purchase a home, reach out to a Rocket Lawyer network attorney for affordable legal advice.

This article contains general legal information and does not contain legal advice. Rocket Lawyer is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.