1. First and foremost, get prepared.

- You can avoid a lot of the pitfalls if you do some homework beforehand and arrive at the car dealership ready.

- Research the price for the car you're interested in, know your spending limit and set a budget.

- Find out your credit score. The better your credit score, the more likely you'll be approved for a car loan and the better your interest rate. The three credit bureaus are Equifax.com, Experian.com, and Transunion.com.

2. Be wary of the dealership's loan offer, because it might not be the best deal for you.

- Consider getting auto financing before you visit the car dealership. You can go to your bank or credit union, or even check with online providers.

- Most dealers will try and get you to focus only on the monthly payment, without allowing you to consider the interest rate. If you know that you qualify for a certain interest rate ahead of time, you can avoid inflated interest rates.

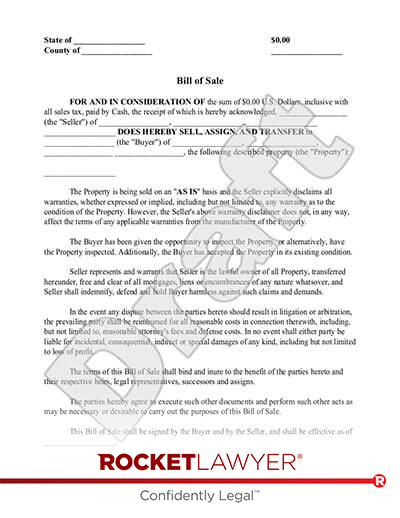

3. Take the time to read and review what you are being asked to sign, and complete a Bill of Sale if needed.

- You may do your best work in negotiating with a salesman verbally and you may shake hands on a final price, but the contract you sign may obligate you to unexpected higher costs, or things you've never discussed. Pay attention and take your time and make sure that the contract explicitly states the monthly payment, the interest rate, and any "extras" (such as an extended warranty, or other items) they may try to get by you.

- Don't waive your rights; for example, in CA and other states there is a cooling off period where you can void the contract for a set amount of time.

- Check for any penalties - late payments, increases in interest rates, etc.

- Check to see if your contract allows you to return the car within a certain time period.

- If you are financing a car sale through a private party (ie, not through a dealership), complete a Car Bill of Sale to transfer ownership of the vehicle.

This article contains general legal information and does not contain legal advice. Rocket Lawyer is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.