Any Loan Agreement states the terms, rights and obligations applying to the loan, but different types of loans may require different specifications to meet local and national standards, so check with your local jurisdiction. Meeting these standards enables you to seek legal help if the other party fails to comply with the terms of the Loan Agreement.

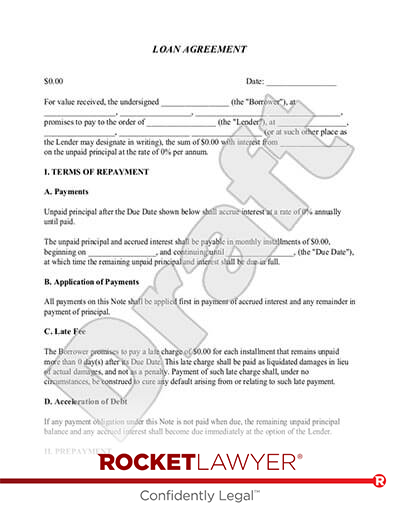

To draft a Loan Agreement, you should include the following:

- The addresses and contact information of all parties involved

- The conditions of use of the loan (what the money can be used for)

- Any repayment options

- The payment schedule

- The interest rates

- The length of the term

- Any collateral

- The cancellation policy

- Any provisions for default

Be aware that other types of loans may require additional details, like language provisions, waivers, and securitization details. A Loan Agreement drafted for a personal loan between individuals doesn't have to be as detailed as one involving banks, organizations or finance companies. However, it's a good idea for individuals to have a written Loan Agreement to refer back to, so that both individual are aware of their responsibilities.

If you are ready to draft your Loan Agreement, use Rocket Lawyer's easy online interview to complete the document in minutes. You can also use Rocket Lawyer to Consult a Legal Pro.

This article contains general legal information and does not contain legal advice. Rocket Lawyer is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.