Make a written demand for money owed to you: Demand for Money Owed

What we’ll cover

What is a Demand for Money Owed?

A Demand for Money Owed letter may be used to make a written demand for money that is owed to you. A Demand Payment letter will provide formal notice that payment is due and that legal action will be taken if payment is not made before a specified date.

The only permissible purpose of the Demand for Money Owed letter is for a creditor to collect debts owed to that creditor. The person preparing and signing this letter must be the person claiming the amount of money owed or be an employee or representative of the business claiming the money owed.

If the letter is not prepared for this purpose, you may be required to comply with the stringent requirements of the Fair Debt Collection Practices Act. Furthermore, your state may have its own collection requirements which must be considered. Get started on yours now with Rocket Lawyer and ask a lawyer about your state’s specific requirements.

When to use a Demand for Money Owed:

- You want to make a written demand for money owed.

- You want your demand for money owed in writing so it can be documented in case of future disputes with the person.

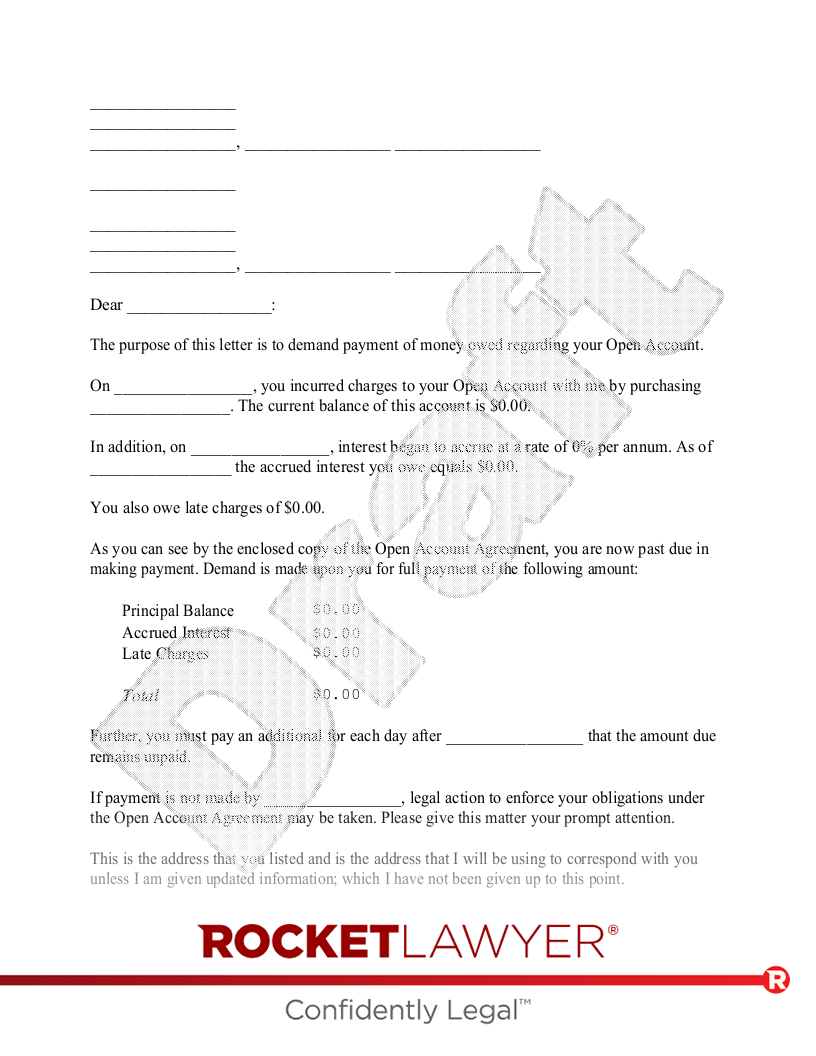

Sample Demand for Money Owed

The terms in your document will update based on the information you provide

,

,

and

The purpose of this letter is to demand payment of money owed regarding your

by purchasing . by contracting for .

are now past due in making payment. Demand is made upon you for full payment of the following amount:

If payment is not made by , legal action to enforce your obligations under the may be taken. Please give this matter your prompt attention.

This is the address that you listed and is the address that I will be using to correspond with you unless I am given updated information; which I have not been given up to this point. at the above address I can be contacted by phone at . I can be contacted via e-mail at . at the above address We can be contacted by phone at . We can be contacted via e-mail at .

Sincerely,

| _____ | should sign the letter. |

| _____ | should sign this letter on behalf of . |

About Demand Letters for Money Owed

Learn about how to make a written demand for money owed to you

-

Dos and Don’ts of the Fair Debt Collection Practices Act

If you’re making a Demand for Money Owed letter, then you might have to familiarize yourself with the Fair Debt Collection Practices Act. It governs the collection of "consumer debt" (defined to include any personal, family, or household debt) by the following types of "Debt Collectors":

- Any person in the business of collecting debts.

- Any creditor who collects debts using a name other than his or her own.

- Anyone who collects or tries to collect debts for another person.

The Act does not apply to individuals, banks, or businesses that collect their own debts using their own names. However, if there is any doubt about whether the Fair Debt Collection Practices Act applies, consult an attorney. This general overview of the scope of the Fair Debt Collection Practices Act is only a rough description and is not a substitute for competent legal advice.

Collecting money for others

If this letter is being prepared to collect money owed to someone else, you should consult a lawyer to determine whether or not you qualify for one of the exceptions under the Fair Debt Collection Practices Act and whether you satisfy your state's requirements for debt collection.

Non-compliance with the Fair Debt Collection Practices Act

If a debt collector does not comply with the Fair Debt Collection Practices Act, the debtor may sue the debt collector within one year after the violation. It may be possible for the debtor to recover actual damages plus additional damages up to $1,000, court costs, and reasonable lawyer's fees.

Contacting the debtor

A debt collector cannot do the following:

- Contact the debtor before 8 a.m. or after 9 p.m.

- Contact the debtor at unusual places.

- Contact the debtor at the place of employment if it is known that the employer prohibits such contact.

- Harass or abuse the debtor. This includes, but is not limited to:

- Using or threatening violence or harm to the person, the person's reputation, or property.

- Using obscene language.

- Publicizing the debt.

- Making annoying, repetitive, or anonymous phone calls.

- Providing false or misleading information as to the collector's identity.

- Collecting an additional fee not authorized by law or by the terms of the debt agreement.

- Charging the debtor with collect calls or telegram fees.

- Communicating by postcard.

- During a period when the debt is being verified, the collector may not ask for payment.

A debt collector may not contact a person other than the debtor except for the purpose of locating the debtor. In doing so, the debt collector must do the following:

- Identify himself or herself.

- Not reveal the consumer's debt.

- Not use a postcard or any other means that might reveal the debt-collection activity.

- Not contact the person more than once unless absolutely necessary.

- If the debt collector learns the identity of a lawyer who is representing the debtor, all future contact must be with that lawyer.

Following up with written correspondence

Within five days after contacting a debtor, the debt collector must send a written letter that includes the following information:

- The amount of the debt.

- The name of the creditor.

- Notice that the debt will be assumed to be valid unless disputed within 30 days.

- Notice that if the debt is disputed, the debt collector will verify the debt and send a copy of supporting documents to the debtor.

For most small business owners, it’s important to remember that the Fair Debt Collection Practices Act does not apply to individuals, banks, or businesses that collect their own debts using their own names. For small businesses and individuals, often sending a Demand for Money Owed letter can be an effective tool to get paid what you are owed. But if you still have questions or concerns about violating debt collection laws, don’t hesitate to ask a lawyer.

Demand for Money Owed FAQs

-

How do you write a Demand Letter for Payment?

Making a Demand Letter for Payment online is simple. Just answer a few questions and Rocket Lawyer will build your document for you. Consider these questions beforehand to make the process speedier:

- What was purchased?

- Are there any interest or late charges owed?

- If payment is not received by a certain date, will there be daily charges? If so, what daily amount will be charged?

- When must payment be made to avoid possible legal action?

If you don't have all of the details you need, you can skip questions and save your document for later.

-

How long should I wait for payment after sending a demand letter?

Rocket Lawyer's Demand for Money Owed will allow you to specify when payment must be made to avoid possible legal action. It is customary to allow approximately 15 to 30 days for payment of money owed before taking legal action.

-

What is included in a Demand for Money Owed letter?

A Demand for Money Owed letter will typically include the following:

- Information about the parties involved.

- Description of goods or services provided.

- How charges were made.

- Deadline for payment.

Our quality guarantee

We guarantee our service is safe and secure, and that properly executed Rocket Lawyer legal documents are legally enforceable under applicable US laws.

Need help? No problem!

Ask a question for free or get affordable legal advice when you connect with a Rocket Lawyer network attorney.