Is it legal for debt collectors to call me?

As a general rule, yes. Debt collectors can call you if they are attempting to make arrangements to collect a debt. However, there are some limitations. For example, debt collectors cannot call you at an "unusual time" or contact you at a place they know is inconvenient.

In general, debt collectors are prohibited from calling before 8 a.m. or after 9 p.m. They also cannot contact you at work if they know that your workplace prohibits personal phone calls.

They can also contact you through other means, such as text messages, email, or mail. However, they cannot discuss your debt with anyone but you or your spouse. If you have an attorney representing you, the debt collector can only contact the attorney about the issue.

How many times is a debt collector allowed to contact me before it is considered harassment?

Although federal law sets out that a debt collector cannot harass you, it does not specifically limit the number of times a debt collector can call you. However, a debt collector is not allowed to repeatedly call you or continuously contact you for the purpose of annoying or abusing you.

You will have to decide whether you think the debt collector is harassing you. For some people, a few calls over a short period may be enough to be considered harassment. In other cases, it may not be considered harassment until after hundreds of calls. A high frequency of calls within a short amount of time is more likely to be considered harassment.

Keep in mind that the FDCPA specifically prohibits debt collectors from harassing consumers. That means that if the debt collector is engaging in harassment, they may have violated the FDCPA—and you might have a legal claim against the debt collector for money damages and attorney fees.

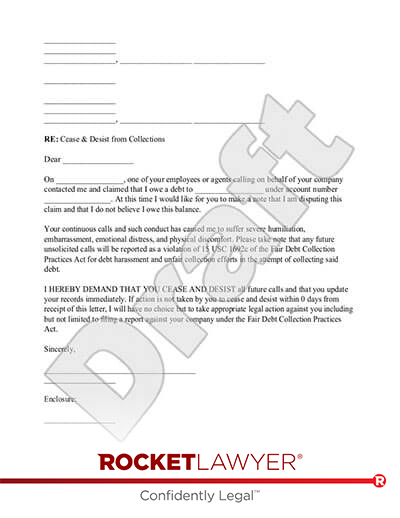

Can I send a Cease and Desist Letter to a collection agency?

If you want a debt collector or collection agency to stop contacting you, you can send a Cease and Desist Letter asking that communication stop. You can also send other communications to request additional information about the alleged debt or set limitations on contacts.

Sending a Cease and Desist Letter, if done properly, will limit or stop communication with the debt collector. If contacts do not stop as requested, you might have a legal claim against the debt collector under the FDCPA.

There are some potential drawbacks to sending a Cease and Desist Letter. If the debt collector can no longer contact you, they may file a lawsuit against you in court. While the Cease and Desist Letter stops communication, it does not stop or otherwise restrict a debt collection agency's rights to seek a money judgment through litigation.

There are a few circumstances when using a Cease and Desist Letter is a good idea.

- The debt collector is harassing you and it is causing significant stress.

- The legal time limit for the creditor to collect on a debt has expired.

- The debt they are trying to collect is not your debt.

If you decide to send a Cease and Desist Letter, be sure to keep a copy for your records.

How does a Cease and Desist Letter stop debt collection harassment?

Debt collectors are only allowed to contact you for two purposes after you send a Cease and Desist Letter:

- To confirm that they received your letter and that there will be no further contact; or

- To notify you that they plan to take legal action, such as starting a lawsuit against you.

If the debt collector contacts you for any other purpose, they will be violating the FDCPA.

There are various nuances regarding debt collection, including statute of limitations, actions that might "confirm" a debt, and a lot more. Before you contact a debt collector, it is a good idea to speak with an attorney about your situation. Reach out to a Rocket Lawyer On Call® attorney for affordable legal advice and answers to your questions about Cease and Desist Letters.

Please note: This page offers general legal information, not but not legal advice tailored for your specific legal situation. Rocket Lawyer Incorporated isn't a law firm or a substitute for one. For further information on this topic, you can Ask a Legal Pro.