1. Determine the level of financial separation that works best at this point in your relationship.

If you and your spouse are young, early in your careers, and don’t have much in terms of money or assets, it may make the most sense to combine all of your accounts. Combining finances often leads to better credit, more income for large expenses like a down payment on a home, and a simpler setup when it comes time to file taxes. The benefits often come as a pleasant surprise to couples after they request their first joint credit report or file their first combined tax return.

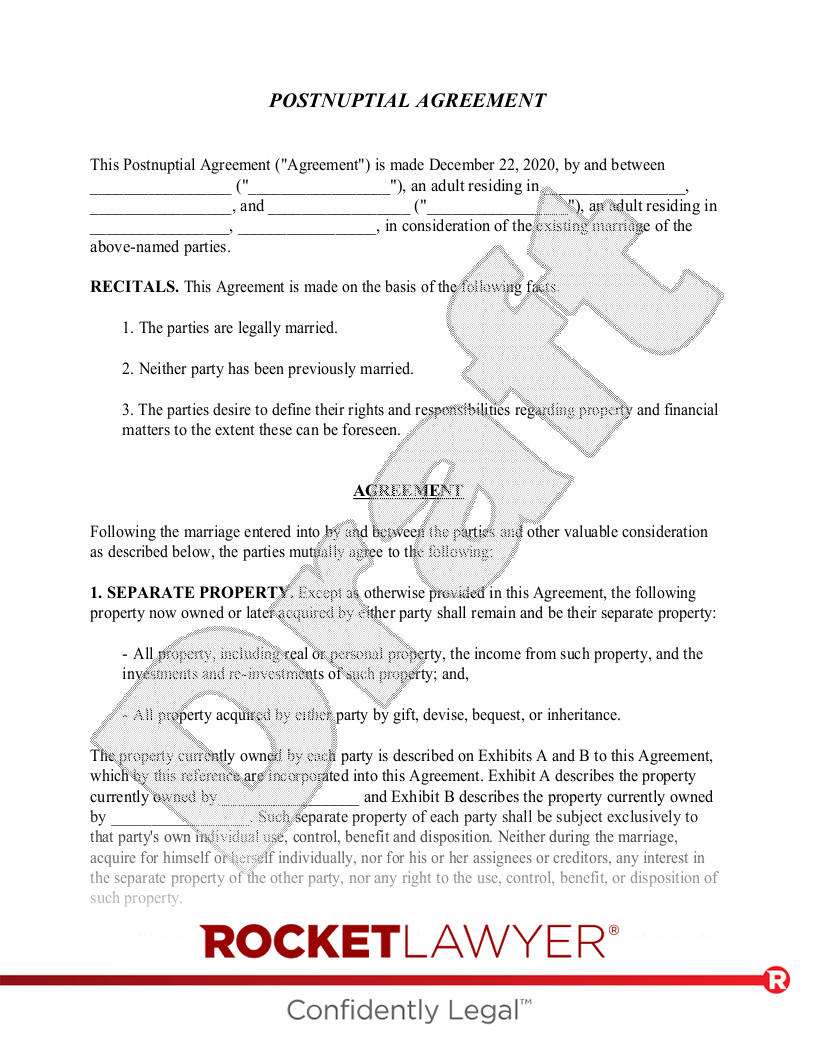

Some couples, especially those who are older and have built savings and careers before marriage, may find they prefer to retain financial independence by maintaining separate accounts. This is especially true if one or both spouses have children from a prior relationship since they may have some financial responsibilities independent of one another. A financial advisor can help you make an informed decision regarding how to handle the finances in your specific situation. Sometimes, couples choose to create a Prenuptial Agreement or Postnuptial Agreement to address these types of issues.

Even if you decide to keep your finances separate, it often makes sense to have at least one checking account held jointly in both names, to which both spouses contribute, for paying the household bills and other shared expenses.

2. Set a household budget.

Before newlyweds combine bank accounts, one of the most important things for them to do is to set a monthly budget. Start by writing down your income, then record all of your expenses. Keep in mind that you can’t spend more than your combined income, or you may end up in debt. It can help to frame a budgeting conversation as a plan for the two of you to work toward mutual goals as a married couple, such as saving for a down payment on a house.

It may emerge in the course of conversations that one spouse is a spender and the other is a saver. If you truly don’t see eye to eye on how to manage your money, this could be a sign that keeping at least some of your finances separate is a good choice. On the other hand, it might be a positive step for your relationship to fully combine finances while setting boundaries that account for your differences. For example, you could decide together to allocate a small amount of money per month for personal use that the other person doesn’t get to question or criticize, while keeping the bulk of your income for bills. This can create space for spending on individual hobbies or interests.

3. Talk openly about debt.

Ideally, you and your spouse would know about one another’s debts – such as student loans or outstanding credit card balances – before getting married. It’s important to speak openly about debt and consider how it might affect the decision to combine finances. While merging your bank accounts can help establish a strong credit score if you both have decent income without much debt, it may be smarter to keep your finances separate if one person has a large amount of debt to help ensure that the other person remains in a good position to get financing for large purchases like a home or vehicle. If one person has a problematic credit history or large amount of debt, you may want to talk to a financial professional to help form a plan to pay it off quickly and manage it moving forward.

4. Set up retirement accounts and start estate planning as soon as possible.

Retirement plans yield better results the sooner they are implemented. Look into the options for setting one up for each of you as soon as you can. Many employers offer the opportunity for employees to contribute to a 401(k) retirement plan, and some even match employee contributions up to a certain percentage. If your employer does not offer a 401(k), you can still look into setting up an IRA as an individual. It is best to start saving for retirement as soon as you can because the longer you have money invested, the greater the potential returns over time.

If you or your partner do have a 401(k) or IRA, discuss how much you already have saved and set goals for how much you plan to set aside each year moving forward. You may want to name each other as your account beneficiaries. However, if either of you has children from previous relationships, you may choose to name them instead. You may also want to engage in estate planning initiatives like writing your Last Will and Testament, creating an Advanced Directive, or obtaining a life insurance policy. You can get started with an Estate Planning Worksheet for Married People.

5. Seek professional advice.

As you decide how to combine finances (or keep them separate) and your goals for retirement, seek advice from a financial planning professional. A financial advisor can help you understand different types of retirement accounts and the risks associated with certain investments, as well as help get you on track to save for large expenses like starting a family or saving for your child’s education.

In addition to a financial advisor, you may also want to contact a Rocket Lawyer network attorney to learn more about setting up an estate plan to support your long term goals.

6. Always be honest.

It is not always going to be easy to make financial decisions as a newly married couple, whether the implications are big, like when buying a home, or small, like when deciding whether eating out for dinner is in the budget. Be honest with one another and check in regularly to see where your finances stand and where you’re heading for the future. Try to involve your spouse in all major financial decisions. As you tackle the big ones together, you are likely to get more comfortable handling the smaller everyday decisions that arise.

If you have more questions about combining your finances after marriage, reach out to a Rocket Lawyer network attorney for affordable legal advice.

This article contains general legal information and does not contain legal advice. Rocket Lawyer is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.