Outline your last wishes in South Carolina: South Carolina Last Will and Testament

What is a South Carolina Last Will and Testament?

The individual making a Will is called the "testator," while the individual or organization appointed to manage the testator's estate after death is known as the "executor." Designed for South Carolina residents, this free Last Will and Testament can be used in Greenville County, Richland County, Charleston County, and in every other part of the state. Each South Carolina Will from Rocket Lawyer can be fully personalized for your unique circumstances. This official document will provide verification of your preferences.

When to use a South Carolina Last Will and Testament:

- You wish to give someone broad authorization to act for you if you are absent or incapable.

- You wish to give someone power to handle certain financial or legal issues in your absence or if you become ill.

- You wish to authorize someone to act on your behalf if case you become legally incompetent or incapacitated.

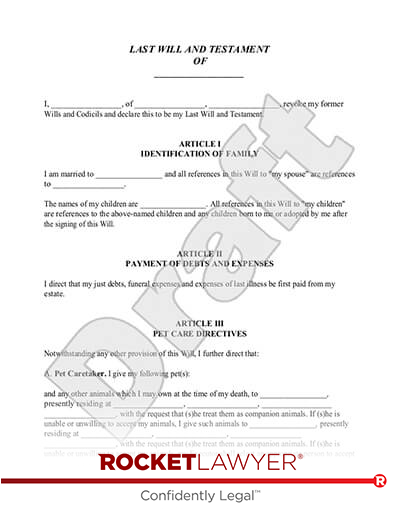

Sample South Carolina Last Will and Testament

The terms in your document will update based on the information you provide

LAST WILL AND TESTAMENT

OF

I, , of , , revoke my former Wills and Codicils and declare this to be my Last Will and Testament.

ARTICLE

IDENTIFICATION OF FAMILY

ARTICLE

PAYMENT OF DEBTS AND EXPENSES

I direct that my just debts, funeral expenses and expenses of last illness be first paid from my estate.

ARTICLE

DISPOSITION OF PROPERTY

% - my spouse, . If my spouse does not survive me, this share shall be distributed

% - my Trustee, to be retained, managed and distributed under the provisions of Article IV (Trust for Children).

% - my children in equal shares. If a child of mine does not survive me, such deceased child's share shall be distributed in equal shares to the children of such deceased child who survived me by right of representation. If a child of mine does not survive me and has no children who survive me, such deceased child's share shall be distributed in equal shares to my other children, if any, or to their respective children by right of representation. If no child of mine survives me, and if none of my deceased children are survived by children, this share shall be distributed State of Commonwealth of , relating to the succession of separate property that is not attributable to a predeceased spouseState of Commonwealth of , relating to the succession of separate property that is not attributable to a predeceased spouse

. my spouse, . If my spouse does not survive me, my residuary estate shall be distributed to , , . If such beneficiary does not survive me, my residuary estate shall be distributed to my heirs-at-law, their identities and respective shares to be determined under the laws of the , then in effect, as if I had died intestate at the time fixed for distribution under this provision.my spouse's heirs-at-law, their identities and respective shares to be determined under the laws of the , then in effect, as if my spouse had died intestate at the time fixed for distribution under this provision. the following beneficiaries in the percentages as shown:. my children in equal shares. If a child of mine does not survive me, such deceased child's share shall be distributed in equal shares to the children of such deceased child who survive me, by right of representation. If a child of mine does not survive me and has no children who survive me, such deceased child's share shall be distributed in equal shares to my other children, if any, or to their respective children by right of representation. If no child of mine survives me, and if none of my deceased children are survived by children, my residuary estate shall be distributed to my heirs-at-law, their identities and respective shares to be determined under the laws of the State of , then in effect, as if I had died intestate at the time fixed for distribution under this provision., relating to the succession of separate property that is not attributable to a predeceased spousemy Trustee, to be retained, managed and distributed under the provisions of the Article titled "Trust for Children". my heirs-at-law, their identities and respective shares to be determined under the laws of the , then in effect, as if I had died intestate at the time fixed for distribution under this provision., , . If such beneficiary does not survive me, my residuary estate shall be distributed to State of Commonwealth of , relating to the succession of separate property that is not attributable to a predeceased spousethe following beneficiaries in the percentages as shown:. , , . If such beneficiary does not survive me, my residuary estate shall be distributed to State of Commonwealth of , relating to the succession of separate property that is not attributable to a predeceased spousemy heirs-at-law, their identities and respective shares to be determined under the laws of the , then in effect, as if I had died intestate at the time fixed for distribution under this provision.my heirs-at-law, their identities and respective shares to be determined under the laws of the , then in effect, as if I had died intestate at the time fixed for distribution under this provision. the following beneficiaries in the percentages as shown:The custodian (whether trustee or guardian) of my children's assets may transfer all or part of the custodial property to a qualified minors trust without court order provided that the trust meets the requirements of Internal Revenue Code section 2503(C).

The shares shall be distributed to my surviving children (and/or surviving descendants, in the case of a deceased child, by right of representation) and this Trust shall then terminate.

to the following beneficiaries in the percentages as shown: to my heirs-at-law, their identities and respective shares to be determined under the laws of the , then in effect, as if I had died intestate at the time fixed for distribution under this provision.to my spouse's heirs-at-law, their identities and respective shares to be determined under the laws of the , then in effect, as if my spouse had died intestate at the time fixed for distribution under this provision.

% to my heirs-at-law, their identities and respective shares to be determined under the laws of the , then in effect, as if I had died intestate at the time fixed for distribution under this provision.

% to my spouse's heirs-at-law, their identities and respective shares to be determined under the laws of the , then in effect, as if my spouse had died intestate at the time fixed for distribution under this provision.

E. Nomination of Trustee. I nominate , of , , as the Trustee, If such person or entity does not serve for any reason, I nominate with bond. without bond. with bond. without bond. the remaining nominee shall serve as sole Successor Trustee, I nominate , of , , to be the replacement Co-Successor Trustee, If such person or entity does not serve for any reason, I nominate with bond.without bond.with bond.without bond.

E. Nomination of Trustee. I nominate , of , , and , of , , as Co-Trustees (the "Trustee"), If one of the above nominees does not serve for any reason, with bond. without bond. with bond. without bond. If such person or entity does not serve for any reason, I nominate with bond. without bond. with bond. without bond. the remaining nominee shall serve as sole Successor Trustee, I nominate , of , , to be the replacement Co-Successor Trustee, If such person or entity does not serve for any reason, I nominate with bond.without bond.with bond.without bond.

is designated as the successor Trustee and , of , are designated as successor Co-Trustees (the "Trustee"). Accounting. The Trustee shall provide an accounting to the Beneficiary (or Beneficiaries) on at least a(n) basis. If a beneficiary has a "disability", the Trustee shall provide the accounting to a guardian or conservator of the beneficiary, if any.

without bond. with bond except that no bond shall be required of any qualified successor corporate Trustee. with bond. , with the following requests:.

. that they take possession of and care for all my animals and search for good homes for them

. that until homes are found for my animals, the animals be placed in foster homes rather than in cages at the shelter

. that if it is necessary to keep some of the animals in cages while making arrangements to fend permanent homes, in no event should any animal stay more than a total of 2 weeks in a cage

. that each animal should receive appropriate veterinary care, as needed

. that after attempts have been made for 3 months to place an animal, that , presently residing at , , , be contacted if it is not possible to place an animal so that he can assist with finding a home for the animal

. that the shelter make every effort to assure that none of my animals are ever used for medical research or product testing or painful experimentation under any circumstances

. that, after placement, shelter personnel make follow-up visits to assure that my animals are receiving proper care in their new homes

. that they take possession of and care for all my animals for the remainder of the animals' lives

.

If is in existence at the time of my death and is able to accept my animals, I give to . and

ARTICLE

NOMINATION OF

I nominate , of , , Dependent Independent to serve as my , and , of , , as Co-s (the ""), to serve with bond. to serve without bond, surety, or other security. If one of the above nominees does not serve for any reason, the remaining nominee shall serve as sole If one (or both) of the above nominees does not serve for any reason, I nominate , of , , as replacement Co- (or sole ), to serve with bond. to serve without bond, surety, or other security.

ARTICLE

Independent shall have all powers and authority granted by law or necessary or appropriate for proper administration. in addition to other powers and authority granted by law or necessary or appropriate for proper administration, shall have the following rights, powers, and authority without order of court and without notice to anyone: to identify, gather, value, secure, manage and distribute assets, to maintain records, to settle and wind up business affairs, to pay just debts, to file necessary tax returns, to redirect mail, to cancel services, to establish trusts, and to carry out my wishes as set forth in this Will.

. Hold Trust Assets as a Single Fund. To hold the assets of the trust, shares, or portions of the trust created by this instrument as a single fund for joint investment and management, without the need for physical segregation, dividing the income proportionately among them. Segregation of the various trust shares need only be made on the books of the Trustee for accounting purposes.

. Compensation. To receive reasonable compensation for their services under this Will and be exonerated from and to pay all reasonable expenses and charges of the estate and trust.

. Loans to Beneficiaries. To make loans to any trust beneficiary for the purpose of providing the beneficiary with the funds necessary to take advantage of exceptional business opportunities or to provide for the needs of the beneficiaries and their families.

. Methods of Distribution. To make payments to or for the benefit of any beneficiary (specifically including any beneficiary under any legal disability) in any of the following ways: (a) directly to the beneficiary; (b) directly for the maintenance, welfare and education of the beneficiary; (c) to the legal or natural guardian of the beneficiary; or (d) to anyone who at the time shall have custody and care of the person of the beneficiary. The or Trustee shall not be obliged to see to the application of the funds so paid, but the receipt of the person to whom the funds were paid shall be full acquittance of the or Trustee.

. Independent Administration. My shall have the right to administer my estate using "informal", "unsupervised", or "independent" probate or equivalent legislation designed to operate without unnecessary intervention by the probate court.

. Compensation. Receive reasonable compensation for their services under this Will and be exonerated from and to pay all reasonable expenses and charges of the estate.

ARTICLE

MISCELLANEOUS PROVISIONS

. Paragraph Titles and Gender. The titles given to the paragraphs of this Will are inserted for reference purposes only and are not to be considered as forming a part of this Will in interpreting its provisions. All words used in this Will in any gender shall extend to and include all genders, and any singular words shall include the plural expression, and vice versa, specifically including "child" and "children", when the context or facts so require, and any pronouns shall be taken to refer to the person or persons intended regardless of gender or number.

predeceased my spouse, and notwithstanding any other provision of this Will, my spouse (or my spouse's estate as the case may be) shall receive the distribution to which my spouse would otherwise be entitled to receive without regard to a survivorship requirement, if any.survived the death of my spouse.Independent

IN WITNESS WHEREOF, I have subscribed my name below, this _____ day of _____________________, _______.

| Testator Signature: | ___________________________________ |

and in the sight and presence of each other,

STATE OF COMMONWEALTH OF ; and subscribed and sworn to before me by and , witnesses

Name of Sole Digital Executor: , City: , State:

Name of Co-Digital Executor: , City: , State:

Name of Co-Digital Executor: , City: , State:

should initial on the bottom margin of each page of the Will. This is done to prevent the substitution of pages. must sign each page of the Will, as required by the Louisiana Civil Code, Article 1577. must sign the pages in the presence of a notary public and at least two competent witnesses.

The Self-Proving Affidavit

The self-proving affidavit ("Proof of Will" in some states) is a document which should be signed in front of a notary public and attached to the end of the Will. The affidavit recites that the requisite formalities were observed in signing the Will.

Although attaching the affidavit has nothing to do with the legality of the Will itself, it can speed the admission of the Will to probate after the death of the Will writer because it eliminates the need to have a witness appear at the probate proceeding to testify that the formalities in signing the Will were followed. The witnesses may not be available later when they are needed. A self-proved Will may be admitted to probate without additional witnesses or affidavits, but it is still subject to contest on such grounds as undue influence, lack of testamentary capacity, or prior revocation.

three two or a notary public. and a notary public. . In, witnesses to a will are not required to be disinterested, but if they are "interested", there is a rebuttable presumption that the witness received the will's benefit through fraud or other undue influence, unless there are two additional disinterested witnesses. If the interested witness can not rebut that presumption, they can not take more than they would have taken if no will had existed at all, if anything. The signature of an interested witness will count towards satisfying 's requirement that non-handwritten wills have two witnesses. . Many states require only two witnesses, but the signature of a third witness provides some protection against the possibility that one of the witness' signatures will be invalid for some reason. For example, a person should not be a witness if that person is a beneficiary under the Will. In most states, if a beneficiary's signature is counted in order to satisfy the minimum number of witnesses, then the Will is not necessarily invalidated, but that "interested witness" may not receive a share of the estate any larger than if the Will writer had died without a will. . Vermont requires three witnesses. The signature of a third witness provides some protection against the possibility that one of the witness' signature will be invalid for some reason. For example, a person should not be a witness if that person is a beneficiary under the Will. In most states, if a beneficiary's signature is counted in order to satisfy the minimum number of witnesses, then the Will is not necessarily invalidated, but that "interested witness" may not receive a share of the estate any larger than if the Will writer had died without a will.

South Carolina Last Will and Testament FAQs

-

How do I write a Will in South Carolina?

It's simple and easy to document your preferences using a free South Carolina Last Will and Testament template from Rocket Lawyer:

- Make your Will - Provide a few simple details, and we will do the rest

- Send or share it - Discuss the document with an attorney, if desired

- Sign it and make it legal - Required or not, having two disinterested witnesses is encouraged

This method is often going to be much less time-consuming than hiring and working with the average provider. If necessary, you can fill out a Last Will and Testament on behalf of a family member, and then have them sign it when ready. Keep in mind that for this document to be accepted as legally valid, the testator must be a mentally competent adult when they sign. If the testator is already unable to make their own decisions, a conservatorship might be required. In this scenario, it's important for you to talk to an attorney .

-

Do I need to make a Will?

Every person over 18 should have a Last Will and Testament in place. Though it's tough to think about, your loved ones will want to know your wishes in relation to guardianship (if applicable), your assets, and your property when you pass away. Typical occasions in which it would be helpful to make or update your Will include:

- You are getting older or dealing with ongoing health issues

- You own or recently sold/bought real estate

- Your marital status has changed

- You are a new parent

Whether your South Carolina Last Will and Testament has been generated as part of a forward-looking plan or created as a result of a recent change in your life, witnesses and/or notarization can often help to protect your document if its authenticity is questioned by a third party.

-

Do I need a lawyer to review my Will in South Carolina?

Writing a Will is normally easy to do; however, you or your executor(s) may still have legal questions. Seeking out a lawyer to proofread your South Carolina Last Will and Testament can be relatively time-intensive. A more cost-effective option is through the On Call network. When you become a Premium member, you can have your document examined by an Rocket Lawyer network attorney with relevant experience. As always, Rocket Lawyer will be by your side.

-

What would it usually cost me to make a Will in South Carolina?

The cost of finding and hiring a traditional law firm to make a Last Will and Testament might add up to anywhere from two hundred to one thousand dollars, depending on where you are. Different from many other Last Will and Testament template websites that you may find, Rocket Lawyer gives Premium members up to 40% in savings when hiring a lawyer, so an attorney from our Rocket Lawyer attorney network can review the situation and take action if you ever need help.

-

Would I need to take additional actions after I make a South Carolina Last Will and Testament?

Upon completing a Last Will, you will have the ability to get to it on any device, anytime. You should feel free to engage with the document in any of the following ways: making edits, downloading it as a Word or PDF document, printing it out, and signing it. Attached to your South Carolina Will, there is a series of instructions on what is next with regard to finalizing your document. Be sure to keep your signed original in a safe location where it can't get wet or otherwise damaged. It is important that someone you trust knows where to find it after you have passed.

-

Does a Last Will and Testament need to be notarized or witnessed in South Carolina?

The specific requirements for Wills are different by state; however, in South Carolina, your document must be signed by two witnesses. As a basic standard, your witnesses will need to be mentally competent individuals who are of sound mind. If one of the two required witnesses is also designated as a beneficiary, then any inheritance/gift to that person is considered void. This issue can be resolved by having a third, disinterested witness sign the Will. Furthermore, it is strongly recommended that you have your Last Will and Testament signed by a notary public in order to emphasize the validity of the document.

-

Does a Last Will and Testament need to be filed in South Carolina?

A Will doesn't have to be filed until the testator passes away. In the state of South Carolina, the executor must file the Will with the probate court within 30 days of the testator's death. Filing a Last Will (along with any specific forms requested by the county) initiates probate.