What are the basic duties of a Will executor?

The basic duties of the executor under the estate administration process can be summarized as reporting to the probate court in the decedent’s state of residency, identifying assets, settling debts, and distributing the remaining assets to the designated beneficiaries or legal heirs. Each of these responsibilities is broken down below.

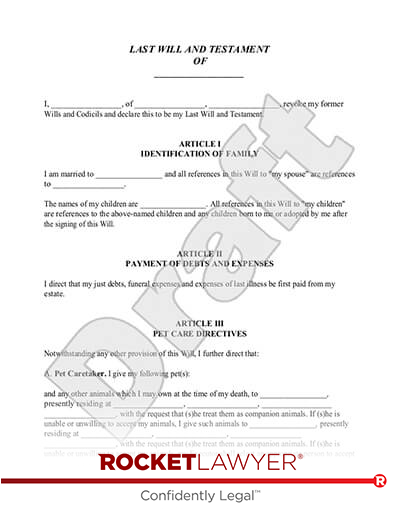

Report to court: The executor is responsible for admitting the Last Will and Testament prepared by the deceased person to the probate court and for applying to the court to appoint them as the recognized executor.

Identify and safeguard assets: The executor is tasked with identifying all assets in the decedent’s estate, including life insurance policies, retirement accounts, checking and savings accounts, and real estate. In addition, they are expected to determine which assets ought to pass to a named beneficiary automatically and which are required to be included under probate.

Settle debts: A major fiduciary duty of the executor is to compile a list of all debts of the decedent and satisfy them. These debts may include medical expenses, utilities, credit cards, estate and court fees, and various taxes.

Distribute remaining assets: In accordance with the terms of the Will, the executor is responsible for distributing the remaining estate assets to beneficiaries of the decedent.

Executors may benefit from using an Executor of Will Checklist, a tool for helping them stay organized throughout the process.

Who cannot serve as a Will executor?

Before choosing an executor, first understand who cannot serve in this capacity in your state of residency. Depending on where you live, the following categories of people may not be able to serve as a Will executor.

Minors: Legally, minors cannot serve as executors in any state.

Convicted felons: Convicted felons, in many states, are not allowed to serve in an executor capacity.

Out-of-state residents or non-US citizens: In some states, your executor is required to be a resident of the state. In others, residents of other states or even countries can serve in this role. However, there will be additional constraints involved. For one, some states require the non-resident executor to post a bond or to name a resident as the executor’s representative. Required time and travel by the non-resident can also slow the overall proceedings.

While a state may place limitations on non-resident executors, who you select may still be appointed by the court with the stipulation that they serve in this capacity along with another individual who is an actual resident of your state. As co-executors, the two can work together in the best interests of the Will’s creator while also keeping each other accountable.

When might I want to name a friend or family member as my executor?

Friends or family members sometimes make good executors and can often be trusted to serve in the best interest of your estate. Two additional reasons to consider a friend or family member include the following benefits:

Familiarity with beneficiaries. Naming a family member as your executor can help as they may know everyone who is a beneficiary. However, it is important to think carefully about whether you want to name someone who is also a beneficiary. If the person you choose is not designated as one of your beneficiaries, or is not receiving a large portion of your estate, it can help ensure that there is no conflict of interest should the beneficiaries fear being taken advantage of when it comes to a fair distribution of assets.

Potential to lower estate administration costs. Naming a family member can also help lower the costs of administration, leaving more assets for the intended beneficiaries. In instances where the executor is also a beneficiary, it is more likely for them to waive the fees associated with serving in that capacity.

What characteristics in friends or relatives might be red flags when considering them as my executor?

While you may be considering naming a friend or relative as your executor, it is essential to consider the following characteristics of each person. If you believe they may be prone to any of these, you may want to talk to a lawyer before you name them as your Will’s executor.

Irresponsible: While you may like them, naming an irresponsible friend or relative as your executor is a bad idea. For peace of mind, knowing your executor is a responsible individual capable of seeing the process through is invaluable to you while you are still alive and to your beneficiaries once you pass.

Lacking financial knowledge: Someone who is bad with finances may not be able to adequately meet your final wishes. Mismanagement of their own finances can indicate an inability to take on yours as well.

Unorganized: Someone who is unorganized may leave out important steps in the probate process, fail to include all assets, and make the process long and drawn out.

Emotional: Someone who may be too emotional after your passing to fulfill their obligations in a timely and legal manner may prolong the process or make mistakes.

Short on time: Someone who is too busy to spend the required time to distribute your assets and report to the probate court can be problematic for all involved.

Does not use technology: If you have digital assets, you may want to select someone with the requisite technological expertise to sort through these adequately and efficiently.

If, after executing your Will, you determine that an executor may be unfit to serve in such a capacity due to any of the above, you can make a Codicil to Will and name a new executor.

If you have concerns or questions concerning your estate planning or in naming an executor, seek legal advice from a Rocket Lawyer network attorney today.

This article contains general legal information and does not contain legal advice. Rocket Lawyer is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.