- Gathering Assets: Once the executor has been appointed, his/her first substantial task is to collect and inventory the assets that are subject to probate. This includes reviewing records, determining which assets are subject to probate, taking physical custody of probate assets, valuing the property, and filing an inventory listing.

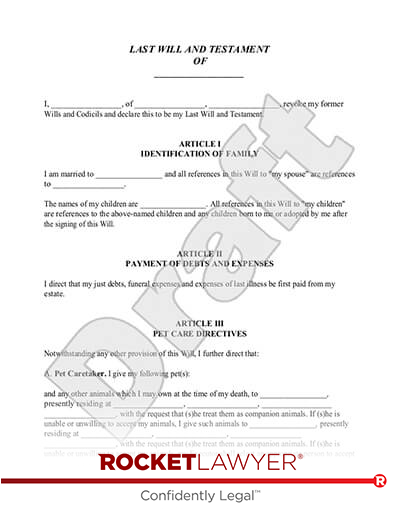

- Payment of Debts and Expenses: Before making distributions to the beneficiaries, the executor must determine what debts and expenses should be paid. The executor is also responsible for resolving claims, paying executor and attorney fees, filing death tax returns, and filing other tax returns. To pay these various costs, the executor may have to liquidate assets.

- Distribution of Assets: After the debts and expenses, including taxes, have been paid, the executor needs to make proper distribution of the remaining assets. This is done through distributions to beneficiaries and establishing trusts.

Related content:

- How to write a will

- What is a living will?

- Will vs. Estate Plan

- Find more information about wills

- Start your will today

This article contains general legal information and does not contain legal advice. Rocket Lawyer is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.