Keep track of important LLC information: Limited Liability Company Worksheet

What is a Limited Liability Company Worksheet?

Starting a new business is an exciting process, and there are a lot of factors to consider. If you have decided to form a LLC, you can use a Limited Liability Company Worksheet to keep organized. Even getting the basic information can be important; being an entrepreneur means getting the little details right, so that the big picture remains in focus.

You can use a Limited Liability Company Worksheet to keep track of a range of information, including: who will sign the articles of organization, name and address of the new company, mailing address, start date of operations, projected number of employees, anticipated amount of revenues, the primary activities of the LLC, the name and address of the owner, its officers, tax information, profit sharing, and benefits for employees.

Because an LLC is formed by filing "Articles of Organization" (also referred to as a "Certificate of Organization" or "Certificate of Formation," depending on state law) which contain a minimum set of required information, a Limited Liability Company Worksheet is a very useful tool in ensuring that you properly prepare for the formation of your LLC. As your new business may be subject to federal and/or state securities laws, you may need to consult an attorney or other advisor for further information.

When to use a Limited Liability Company Worksheet:

- You're forming a new limited liability company (LLC).

- You manage such a company.

Take the next step: Register your LLC now

Many business owners opt to register their LLC after creating a Limited Liability Company Worksheet. If this sounds like you, Rocket Lawyer can make your next step easy.

With Rocket Legal+, you can get fast, personalized support to start your LLC. Your first registration is FREE*, and you can keep your LLC compliant with HALF OFF professional services for trademarks, taxes, and more. *See details

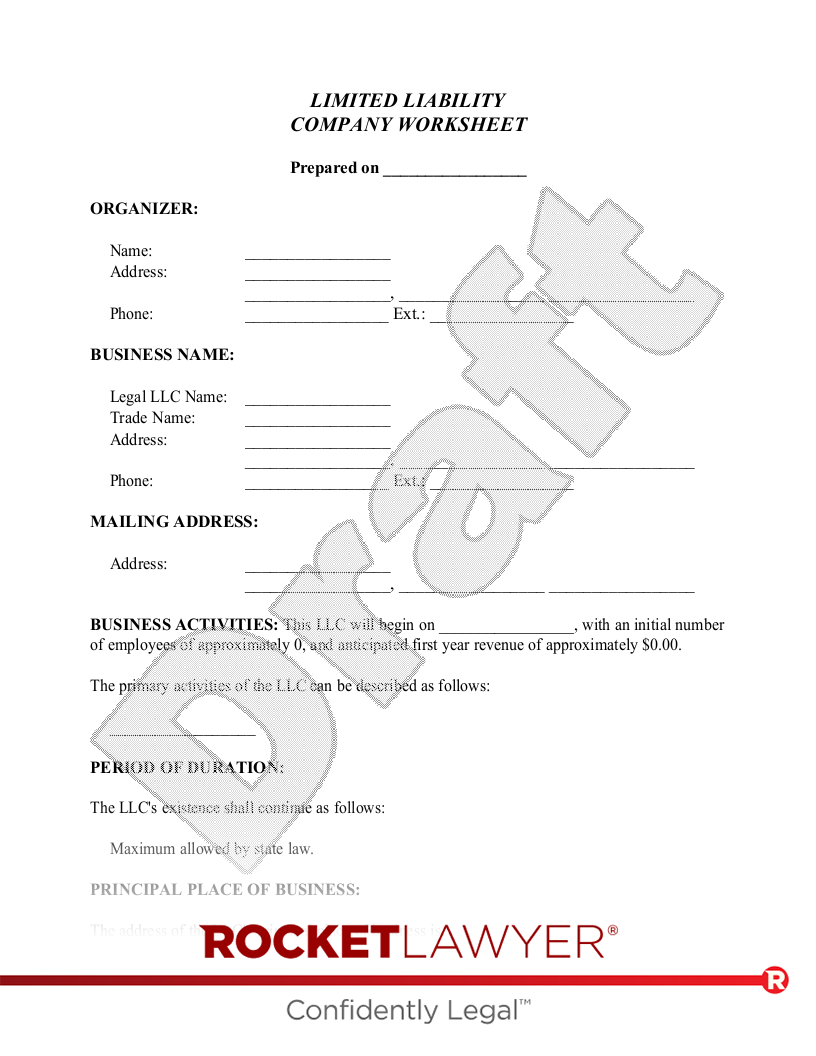

Sample Limited Liability Company Worksheet

The terms in your document will update based on the information you provide

LIMITED LIABILITY

COMPANY WORKSHEET

Prepared on

ORGANIZER:

| Name: |

| Address: |

,

| Phone: | Ext.: |

BUSINESS NAME:

| Legal LLC Name: |

| Trade Name: |

| Address: |

,

| Phone: | Ext.: |

MAILING ADDRESS:

| Address: |

,

BUSINESS ACTIVITIES: This LLC will begin on , with an initial number of employees of approximately , and anticipated first year revenue of approximately .

The primary activities of the LLC can be described as follows:

PERIOD OF DURATION:

The LLC's existence shall continue as follows:

PRINCIPAL PLACE OF BUSINESS:

The address of the LLC's principal place of business is:

,

MEMBERS:

MANAGEMENT:

must be members of the LLC.need not be members of the LLC.

OFFICERS:

TAX MATTERS MEMBER:

The designated member who will be responsible for tax matters is:

| Name: |

| Address: |

,

| Phone: | Ext.: |

VOTING:

Members shall be entitled to vote based upon the following:

Regular matters that require a vote of the members shall be approved by

A(n) vote of the members is required in order to authorize the following acts:

a majority all percent

MEETINGS:

Meetings of the members of the LLC will be held at

PROFIT ALLOCATION:

Net income or net loss of the LLC will be allocated to the members

REGISTERED AGENT:

The name and address of the registered agent of the LLC is:

| Name: |

| Company: |

| Address: |

,

| Phone: | Ext.: |

GEOGRAPHICAL AREA OF BUSINESS OPERATIONS:

The business will conduct its operations in the following geographical area:

Health care plan for employees

Life insurance benefits for employees

Pension or profit-sharing plan

| Accountant: |

| Firm: |

| Address: |

,

| Phone | Ext.: |

| Lawyer: |

| Firm: |

| Address: |

,

| Phone: | Ext.: |

| Insurance Agent: |

| Agency: |

| Address: |

,

| Phone: | Ext.: |

| Banker: |

| Bank: |

| Address: |

,

| Phone: | Ext.: |