What is the difference between traditional and alternative business financing?

A traditional loan usually comes from a bank or other financial institution, such as a credit union. The lender may have rigid qualifications for businesses, and if a company does not meet those requirements, it will usually be rejected for a loan. Many lenders reject applicants that do not meet the following conditions:

- In operation for several years.

- Proven track record of revenue and expenses.

- Very good credit history or credit score.

- Annual profit numbers above a specific threshold amount.

The main obstacle for budding entrepreneurs is that a traditional loan requires demonstrated success. This often means that getting a traditional business loan may not be an option for a new business trying to open its doors.

Traditional lenders have been around for a long time, but there are other viable options. Alternatives range from family and friends to angel investors to online crowdfunding.

How can I qualify for small business loans through banks?

Bank loans are a traditional means to raise capital for your business. Although lending has gotten tighter in some industries, many banks do lend to smaller companies just getting started. If you can present a viable growth plan, then banks may provide support.

Different banks may have differing qualifications for small business borrowers. Still, the loan applications typically cover the same ground. Here are some of the most common eligibility requirements so you can begin to determine whether you might qualify:

Credit scores

Many banks ask the business owner to guarantee or co-sign for the loan. As a result, individuals generally have fair or good credit to qualify, just as they would for a personal loan. A traditional bank may require a credit score of at least 690 to obtain a small business loan.

More established businesses have their own credit score, ranging from 0 to 100, unlike individual scores that go up to 850. The higher the business credit score, the more likely the business will qualify for a loan. Better credit scores also generally mean better interest rates. Bad credit usually leads to higher interest rates.

Annual revenue and years in business

Banks and credit unions may want a demonstrated history of steady revenue to qualify for a small business loan. The longer a company has been in business, the more likely it will be to qualify for a loan with a traditional lender as well.

Showing revenue and profits through careful records is critical. Meeting tax obligations and tracking expenses also tends to impress traditional lenders.

Collateral

Traditional banks like collateral paired with a business loan. Collateral protects the bank in case a business fails or has a dip in revenue. The collateral can be a business asset, such as real estate or equipment. For equipment loans or financing, you can often post the equipment you are purchasing as collateral.

Individual business owners can also pledge personal collateral for a business loan. It is common for a business loan to take a second-position mortgage on a business owner’s home.

Incorporation or LLC formation

Traditional lenders may favor an entrepreneur who has incorporated their business or formed an LLC. Sole proprietorships can function very well, but traditional banks may view them as a hobby or side project instead of a fully functioning company.

Before you apply for a business loan, consider incorporating or forming an LLC, and operating under that name. Functioning as a separate entity is also a good way to decrease liability and build up the business’s credit score.

What are examples of alternative lending?

Alternative lending is a good substitute for traditional bank loans, even if they may require some additional work and creativity.

SBA loans

The Small Business Administration (SBA) provides loans to qualifying businesses. These loans are desirable because they often have lower interest rates and flexible repayment plans. In some cases, they may not require the same guarantees as traditional banks. They usually have lower fees, too.

The application process is somewhat daunting, however, since the SBA loan program is specifically designed to help small businesses having trouble getting a loan through more traditional means.

Loans from friends and family

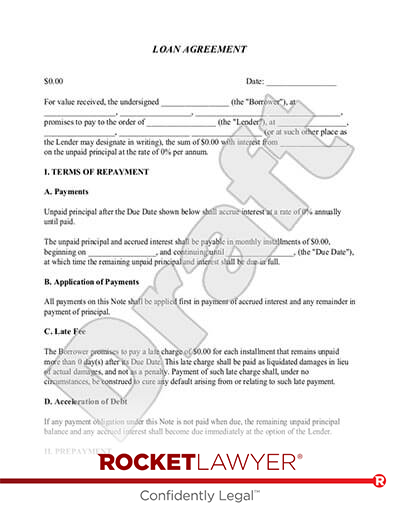

Those who know you best are a viable funding option for your venture. People who are familiar with your business and your goals will know the risk of the investment. Friends and family can be great resources for personal loans, but you do not want to take advantage of their generosity. Using a written Loan Agreement is a good idea, even when getting a loan from a close family member.

Grants

A grant does not require repayment. This form of funding is somewhat rare, but small businesses are often targets for grants, especially in certain local areas. You might also find grants from the local Chamber of Commerce or from groups or entities looking to support budding small businesses in certain industries.

Business grants are often overlooked as a funding source, but they can be extremely helpful. Even if you think it is unlikely that you will qualify for or receive a grant, it can be worth the time and effort to apply.

Crowdfunding

Crowdfunding is a relatively recent phenomenon where large groups of individuals fund a business venture or project instead of a lending institution or several larger investors. Crowdfunding is a peer-lending mechanism that may involve a large number of people contributing relatively small amounts of money through a platform to support a particular idea or project.

While most crowdfunding involves donations or rewards, there are options that allow people to take equity in your company. You can even crowdfund with debt, where individuals provide small loans to fund the venture that must be paid back over time.

Microloans

A microloan is a small loan available from banks and non-bank sources. These loans might be from other companies, but they might also be from nonprofits or even individuals. Most loan amounts are under $50,000 and have short-term repayment periods, typically under five years. These loans can also be from the SBA or local governments as well.

Angel investors

Angel investors often have a high net worth and can help jumpstart your business. Attracting this type of investor requires a good Business Plan, a solid grasp of your financials, and the right networking.

Venture capitalists

Venture capital investors are often interested in coming in to help you run the business or at least have more say in the day-to-day operations. They may want a specific return for their funds, so cash flow is a key consideration. They tend to provide business funding to more established companies.

Equity or debt capital

Equity capital features selling portions of your business to generate funds. The most common example of this is selling shares of stock, but it can also involve bringing in an investor who takes partial ownership or equity. These new owners can either have some control over the company or operate strictly as an investor, with little to no say in how the business runs on a daily basis.

Debt capital refers to any new loan or line of credit where you get funds now but repay them later. Debt capital can come from traditional banks or small business financing arrangements such as:

- Personal loans through online lenders.

- Bonds.

- Credit card debt, including business credit cards.

- Revolving lines of credit.

- Merchant cash advances.

- Short term business loans.

These funds almost always have an interest rate, which means that it will cost you over time to obtain these funds upfront. The repayment terms may not be as favorable as a traditional provider, but they usually provide fast funding and relatively straightforward loan applications. They can provide lump sum working capital or periodic payments.

Invoice factoring

Factoring refers to selling a business’s receivables. By selling future revenue, you can get funds to jumpstart your business. Many companies operate on a net-30 or net-15 structure, and that delay in getting paid can hinder short-term growth.

Although factoring, sometimes called invoice financing, can get you quick cash, it comes at a price. Companies that purchase receivables generally take a percentage of those receivables as their fee, known as the factor rate. Those fees can range a great deal. The fees can sometimes be just a couple of percentage points, but can add up quickly.

How do I know what is right for my business?

Knowing what is right for your business is no simple task. It involves taking a step back to look at your business from a different angle. Understanding your finances, your liabilities, your market, and your expected returns is critical. After all, as a business owner, you want to be sure in your investment of time and money. Seeking professional advice can often help business owners see the big picture and break down the steps they need to take to achieve their goals.

If you have more questions about traditional or alternative funding for your business, reach out to a Rocket Lawyer network attorney for affordable legal advice.

Please note: This page offers general legal information, not but not legal advice tailored for your specific legal situation. Rocket Lawyer Incorporated isn't a law firm or a substitute for one. For further information on this topic, you can Ask a Legal Pro.