Set expectations for a business partnership: Partnership Agreement

What we’ll cover

What is a Partnership Agreement?

A Partnership Agreement is a contract between one or more businesses or individuals who are choosing to run a business together. Partnership Agreements define the initial contribution and future contributions that are expected of the partners.

Sometimes referred to as a Partnership Contract or a Business Partnership Agreement, they outline how business decisions are made, how to determine partnership percentages, how the business will be managed, and more. You may also define finer details, such as management roles, required work hours, and vacation time allowed.

Making your own Partnership Agreement with Rocket Lawyer is easy. Just answer a few questions, and we will build the document for you. Get started now!

When can you use a Partnership Agreement?

- You want to outline the terms of a new business partnership in writing.

- You have a business partner and want to protect your business from potential disputes.

Sample Partnership Agreement

The terms in your document will update based on the information you provide

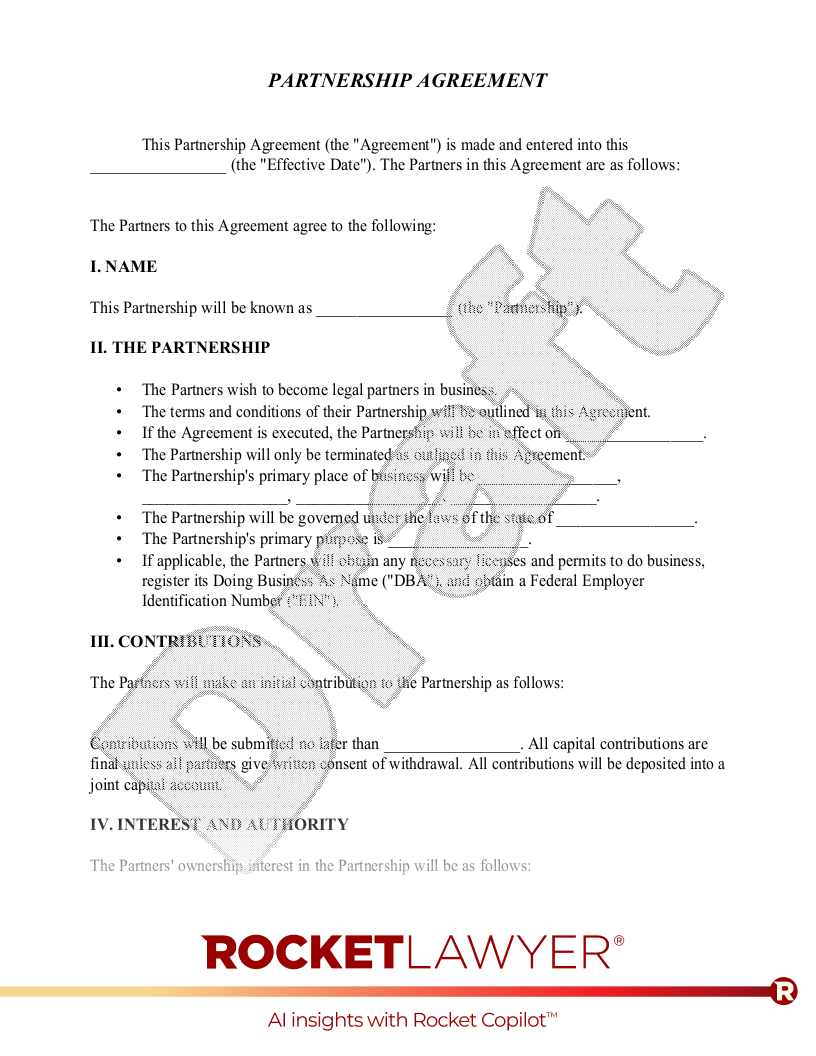

PARTNERSHIP AGREEMENT

This Partnership Agreement (the "Agreement") is made and entered into this (the "Effective Date"). The Partners in this Agreement are as follows:

| Partner Name |

| Address |

| City | State |

| ZIP Code |

The Partners to this Agreement agree to the following:

. NAME

This Partnership will be known as (the "Partnership").

. THE PARTNERSHIP

| The Partners wish to become legal partners in business. |

| The terms and conditions of their Partnership will be outlined in this Agreement. |

| If the Agreement is executed, the Partnership will be in effect on . |

| The Partnership will only be terminated as outlined in this Agreement. |

| The Partnership's primary place of business will be , , , . |

| The Partnership will be governed under the laws of the state of . |

| The Partnership's primary purpose is . |

| If applicable, the Partners will obtain any necessary licenses and permits to do business, register its Doing Business As Name ("DBA"), and obtain a Federal Employer Identification Number ("EIN"). |

. CONTRIBUTIONS

The Partners will make an initial contribution to the Partnership as follows:

| : |

Contributions will be submitted no later than . All capital contributions are final unless all partners give written consent of withdrawal. All contributions will be deposited into a joint capital account.

. INTEREST AND AUTHORITY

The Partners' ownership interest in the Partnership will be as follows:

| : % |

The Partners' authority will be defined by the following unless otherwise stated in the Agreement:

The Partnership has chosen an entity to act as the Partnership Representative, and thus has elected as the "Designated Individual".

. COSTS

The Partners will share costs according to the following percentages:

| : |

. PROFITS

The Partners will share the net profits of the Partnership according to the following percentages:

| : |

The Profits will be accounted by and distributed on the of the month according to the above percentages after the costs of the Partnership have been paid according to the above cost percentages.

. SALARY

All Partners must give their unanimous consent if a permanent salary is to be established and their unanimous consent for the amount of salary to be given to each Partner.

| Management Roles: |

| Work Hours: Each partner agrees to work hours per week, excluding vacation weeks or weeks with a federal holiday. |

. ACCOUNTING

| All accounts related to the Partnership including contribution and distribution accounts will be audited |

| All Partners will maintain a joint contribution account. All Partners will maintain distribution account. Partners will keep accurate and complete books of account for all accounts related to the Partnership. Any Partner, whether majority or minority, will be allowed to review all books of account at any time they request. |

| Each Partner will be responsible for his or her own taxes on any distributions made. |

| Accounting records will be kept on a |

| The fiscal year will be complete on the last day of of each year. All Partners will present their position on the state of the Partnership within two weeks of the completion of each fiscal year. |

. NEW PARTNERS

The Partnership will amend this agreement to include new partners upon the written and unanimous vote of all Partners.

The name of the Partnership may be amended if a new Partner is added to the Partnership upon the written and unanimous vote of all Partners.

. WITHDRAWAL OR DEATH

The Partners hereby reserve the right to withdraw from the Partnership at any time. Should a Partner withdraw from the Partnership because of choice or death, the remaining Partners will have the option to buy out the remaining shares of the Partnership. Should the Partners agree to buy out the shares, the shares will be bought in equal amounts by all Partners. The Partners agree to hire an outside firm to assess the value of the remaining shares. Only upon the partners' unanimous agreement will the outside firm's valuation of the shares be considered final. The Partners will have days to decide if they want to buy the remaining shares together and disperse them equally. If all Partners do not agree to buy the shares, individual Partners will then have the right to buy the shares individually. If more than one Partner requests to buy the remaining shares, the shares will be split equally among those Partners wishing to purchase the shares. Should all Partners agree by unanimous vote, the Partnership may choose to allow a non-Partner to buy the shares thereby replacing the previous Partner.

If no individual Partner(s) finalize a purchase agreement by days, the Partnership will be dissolved.

The name of the Partnership may be amended upon the written and unanimous vote of all Partners if a Partner is successfully bought out.

. DISSOLUTION

Should the Partnership be dissolved by vote, the Partnership will be liquidated, and the debts will be paid. All remaining funds after debts have been paid will be distributed based on the percentage of ownership interest outlined in this Agreement.

. AMENDMENTS

| Amendments may be made hereto upon the unanimous and written consent of all Partners. |

| Amendments must be expressly written and have the original signatures of all Partners. |

| All amendments, notices, requests, claims, demands and other communications between the parties shall be in writing. All such written communications shall be given (i) by delivery in person, (ii) by a nationally recognized next day courier service, (iii) by first class, registered or certified mail, postage prepaid, (iv) by facsimile or (v) by electronic mail to the addresses of the parties specified in this Agreement or such other addresses specified in writing. All notices shall be effective upon (i) receipt by the party to which the written communication is given, or (ii) on the 5th day following mailing, whichever occurs first. |

Any controversies or disputes arising out of or relating to the Partnership or this Agreement will be submitted to mediation in accordance with any statutory rules of mediation in the state of . If mediation does not successfully resolve the dispute or is unavailable, the parties may proceed to seek an alternative form of resolution in accordance with any other rights and remedies afforded to them by law.

IN WITNESS WHEREOF, this Agreement has been executed and delivered in the manner prescribed by law as of the Effective Date first written above.

| By: | Date: |

About Partnership Agreements

Learn how to set expectations for a business partnership

-

What should a Partnership Agreement include?

It's easy to write a Partnership Agreement using Rocket Lawyer. Just answer a few simple questions, and Rocket Lawyer will build your customized contract. As a Rocket Lawyer Premium member, you can access, copy, edit, and email your Partnership Agreement directly from your account. Your document can also be electronically signed or downloaded in PDF or Word format.

Here are some examples of information that your Partnership Agreement should include:

Contact information

- Contact information for the person organizing the partnership.

- Contact information for the business itself.

Business details

- Legal name of the partnership, as well as the trade or business name, if applicable.

- Description of what the business does.

- Start date of your business operations.

- Expected number of employees.

- Expected revenue.

- End date, if applicable.

Partner and personnel details

- Percentage of ownership for each partner.

- Partner contributions.

- How a partner can leave the company.

- What happens if a partner dies.

- Non-compete requirements.

- Non-partner employee details.

Tax responsibilities

- Who will be responsible for tax matters.

- When your fiscal year ends.

Voting rights

- How voting rights will be distributed.

- How much of a vote is required to make business decisions.

A Partnership Agreement can create significant legal obligations for each partner. With that in mind, it is important to review the document carefully to ensure that you agree with all of the details, duties, and procedures specified. A Rocket Legal Pro can help answer any questions.

Partnership Agreement FAQs

-

Why is a Partnership Agreement important?

A Business Partnership Agreement helps to outline the terms of a new business partnership. Without a Partnership Agreement in place, partners may find themselves in disagreement about how to run the business. A written Partnership Agreement that outlines basic business practices can help to prevent future conflicts before they start.

A Partnership Agreement allows you to outline the terms of your new business relationship. You can list all partners to the agreement, as well as their contribution amounts, ownership interest percentages, cost share, profit share, and responsibilities. This contract helps you define the terms of your business engagement, how the business will be operated, and ultimately, how the partnership may dissolve.

If you are ready to go into business with one or more partners, it may be time to make a Partnership Agreement. If you have questions about forming a business partnership, ask a Legal Pro.

-

What are the most common types of partnerships?

There are several types of partnerships, with the most common being general partnerships, limited partnerships, and limited liability partnerships (LLPs). Each type has different characteristics and levels of liability for the partners, and may fall under different agreements. It’s important to define the type of partnership you have before signing.

-

How are profits and losses handled in a Partnership Agreement?

It depends, but the Partnership Agreement may specify how profits and losses are distributed among the partners to help avoid future disputes. This distribution might be based on the partners' capital contributions or other agreed-upon criteria.

-

What happens in the event of a dispute between partners?

The Partnership Agreement can specify mechanisms for resolving disputes, such as mediation or arbitration, as agreed upon by the parties prior to signing. It may also outline procedures for the dissolution of the partnership in extreme cases.

Our quality guarantee

We guarantee our service is safe and secure, and that properly executed Rocket Lawyer legal documents are legally enforceable under applicable US laws.

Need help? No problem!

Ask a question for free or get affordable legal advice when you connect with a Rocket Lawyer network attorney.