1. Accept credit cards

While accepting credit cards may not be right for every business or every transaction, doing so allows you to place the burden of collection on a third party, namely a credit card company.

If your customers purchase goods from you, the small fee you'll pay to accept credit cards is much less than it costs to hire an attorney or outside agency to collect the debt. Let your customers' credit card issuers deal with collecting the debt while you stick to what you do best: running your business.

2. Do a credit check

Since credit checks can take a little time and money, they are especially important when your client or customer will be owing you a large sum. Don't bother running one for a $40 transaction. That simply isn't worth your time. But if you're entering into a long-term relationship or one with a large impact on your bottom line, run a credit check. It might not guarantee payment, but it can help you avoid problem clients and customers up front.

3. Check references

Again, this tip is most important if you're planning on doing large or continued business with a client or customer. Contact your potential client's past business partners and make sure those partners had positive experiences and were able to get paid in a timely manner. Invite your potential client to do the same with your past business partners as well.

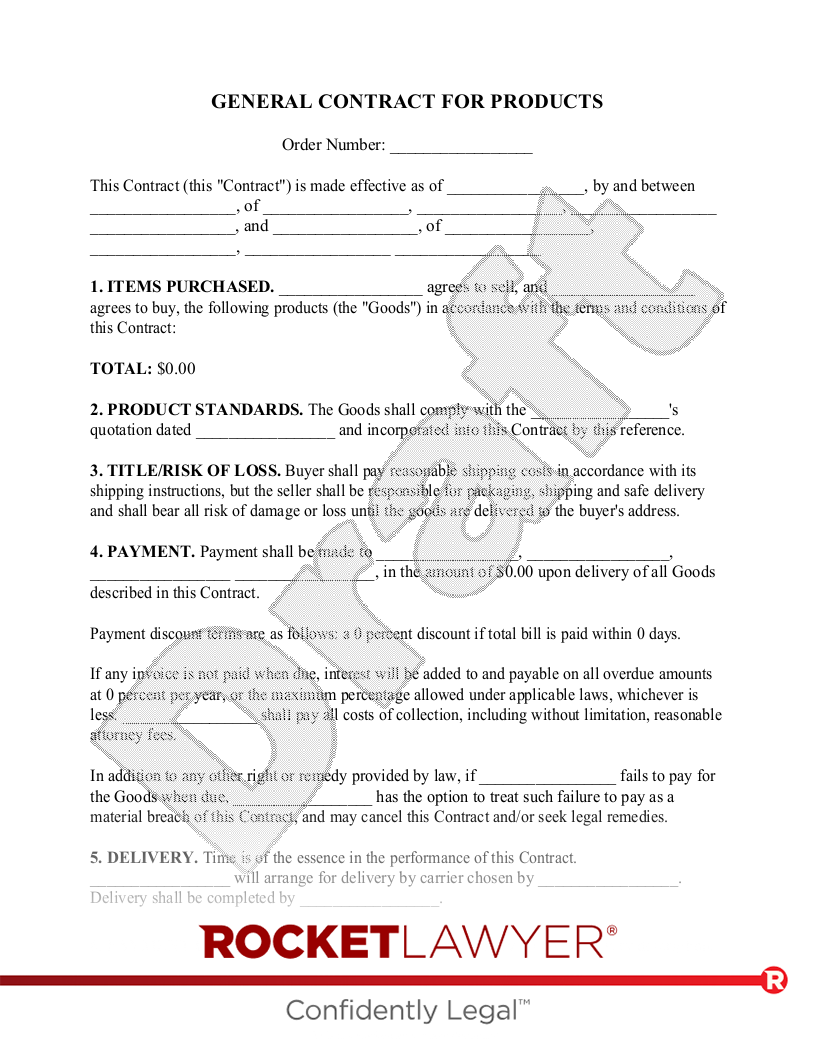

4. Write a good contract

Putting the terms of your arrangement (especially the payment amounts and due dates) in writing is a must. By having your customer agree to the terms in writing, you help ensure that everything is clearly communicated and agreed upon. They have a much harder time making excuses like, "I didn't say that I would pay you that much!" That's why you need to have it in your contract. You can make your Business Contract and many other types of contracts online with Rocket Lawyer.

5. Make polite contact

Before you call a debt collection agency or an attorney, it's a great idea to simply contact your delinquent customer or client. Send another Invoice and call, text or email. It's totally possible they just forgot, or maybe they just put the check in the mail, albeit late. In this instance, a polite reminder or a 30-Day Past Due Letter can do wonders.

But no matter what, people, in general, are much more likely to pay if you're positive and polite. A phone call, email, or letter that simply asks them if they realize they're behind on their payments is the best way to begin.

The hard truth is that sometimes, you'll end up with a delinquent debtor. Sometimes you may want to consider offering a Payment Plan if your customer or client falls on hard times. No matter how diligent you are up front or how much care you take selecting business partners, you can end up dealing with the debt collection process. But by following the five tips here, you can effectively reduce the amount of problem debtors you'll have to deal with.

If you have questions about your options when it comes to collecting a debt, reach out to a Rocket Lawyer network attorney for affordable legal advice. If you need tax help, Rocket Lawyer can now match you with a tax pro for affordable and convenient tax filing services. Leave your taxes to a pro with Rocket Tax!

Please note: This page offers general legal information, not but not legal advice tailored for your specific legal situation. Rocket Lawyer Incorporated isn't a law firm or a substitute for one. For further information on this topic, you can Ask a Legal Pro.