Set out your wishes for assets and guardianship: Last Will and Testament

What we’ll cover

What is a Last Will and Testament?

A Last Will and Testament is a legal document that sets forth your preferences regarding asset distribution after death, such as who will inherit your personal belongings, your money, or your home.

The person making a Will is known as the "testator," while the individual or organization appointed to oversee the testator's estate after death is called the "executor." As a result of having this essential document, your executor(s) will have a point of reference for your decisions.

When can you use a Last Will and Testament?

- You'd like your property distributed according to your wishes after your death.

- You'd like to specify the people or organizations that will and will not receive your property after your death.

- You'd like to list the person or group who will carry out the terms of the last Will.

- You'd like to name who's responsible for minor children if their other parent is unable to take care of them.

- You want to ensure certain people can access your digital assets, such as saved documents, photos, email accounts, social media websites, online backup services, file sharing websites, domain names and other accounts or digital property.

- Note: If the value of what you own is going to be larger than the federal estate tax exemption amount, it's a good idea to get an attorney.

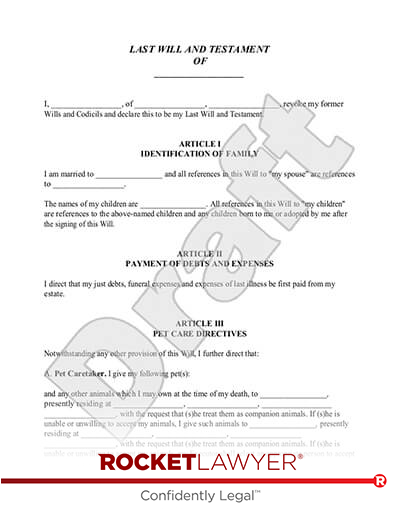

Sample Last Will and Testament

The terms in your document will update based on the information you provide

LAST WILL AND TESTAMENT

OF

I, , of , , revoke my former Wills and Codicils and declare this to be my Last Will and Testament.

ARTICLE

IDENTIFICATION OF FAMILY

ARTICLE

PAYMENT OF DEBTS AND EXPENSES

I direct that my just debts, funeral expenses and expenses of last illness be first paid from my estate.

ARTICLE

DISPOSITION OF PROPERTY

% - my spouse, . If my spouse does not survive me, this share shall be distributed

% - my Trustee, to be retained, managed and distributed under the provisions of Article IV (Trust for Children).

% - my children in equal shares. If a child of mine does not survive me, such deceased child's share shall be distributed in equal shares to the children of such deceased child who survived me by right of representation. If a child of mine does not survive me and has no children who survive me, such deceased child's share shall be distributed in equal shares to my other children, if any, or to their respective children by right of representation. If no child of mine survives me, and if none of my deceased children are survived by children, this share shall be distributed State of Commonwealth of , relating to the succession of separate property that is not attributable to a predeceased spouseState of Commonwealth of , relating to the succession of separate property that is not attributable to a predeceased spouse

. my spouse, . If my spouse does not survive me, my residuary estate shall be distributed to , , . If such beneficiary does not survive me, my residuary estate shall be distributed to my heirs-at-law, their identities and respective shares to be determined under the laws of the , then in effect, as if I had died intestate at the time fixed for distribution under this provision.my spouse's heirs-at-law, their identities and respective shares to be determined under the laws of the , then in effect, as if my spouse had died intestate at the time fixed for distribution under this provision. the following beneficiaries in the percentages as shown:. my children in equal shares. If a child of mine does not survive me, such deceased child's share shall be distributed in equal shares to the children of such deceased child who survive me, by right of representation. If a child of mine does not survive me and has no children who survive me, such deceased child's share shall be distributed in equal shares to my other children, if any, or to their respective children by right of representation. If no child of mine survives me, and if none of my deceased children are survived by children, my residuary estate shall be distributed to my heirs-at-law, their identities and respective shares to be determined under the laws of the State of , then in effect, as if I had died intestate at the time fixed for distribution under this provision., relating to the succession of separate property that is not attributable to a predeceased spousemy Trustee, to be retained, managed and distributed under the provisions of the Article titled "Trust for Children". my heirs-at-law, their identities and respective shares to be determined under the laws of the , then in effect, as if I had died intestate at the time fixed for distribution under this provision., , . If such beneficiary does not survive me, my residuary estate shall be distributed to State of Commonwealth of , relating to the succession of separate property that is not attributable to a predeceased spousethe following beneficiaries in the percentages as shown:. , , . If such beneficiary does not survive me, my residuary estate shall be distributed to State of Commonwealth of , relating to the succession of separate property that is not attributable to a predeceased spousemy heirs-at-law, their identities and respective shares to be determined under the laws of the , then in effect, as if I had died intestate at the time fixed for distribution under this provision.my heirs-at-law, their identities and respective shares to be determined under the laws of the , then in effect, as if I had died intestate at the time fixed for distribution under this provision. the following beneficiaries in the percentages as shown:The custodian (whether trustee or guardian) of my children's assets may transfer all or part of the custodial property to a qualified minors trust without court order provided that the trust meets the requirements of Internal Revenue Code section 2503(C).

The shares shall be distributed to my surviving children (and/or surviving descendants, in the case of a deceased child, by right of representation) and this Trust shall then terminate.

to the following beneficiaries in the percentages as shown: to my heirs-at-law, their identities and respective shares to be determined under the laws of the , then in effect, as if I had died intestate at the time fixed for distribution under this provision.to my spouse's heirs-at-law, their identities and respective shares to be determined under the laws of the , then in effect, as if my spouse had died intestate at the time fixed for distribution under this provision.

% to my heirs-at-law, their identities and respective shares to be determined under the laws of the , then in effect, as if I had died intestate at the time fixed for distribution under this provision.

% to my spouse's heirs-at-law, their identities and respective shares to be determined under the laws of the , then in effect, as if my spouse had died intestate at the time fixed for distribution under this provision.

E. Nomination of Trustee. I nominate , of , , as the Trustee, If such person or entity does not serve for any reason, I nominate with bond. without bond. with bond. without bond. the remaining nominee shall serve as sole Successor Trustee, I nominate , of , , to be the replacement Co-Successor Trustee, If such person or entity does not serve for any reason, I nominate with bond.without bond.with bond.without bond.

E. Nomination of Trustee. I nominate , of , , and , of , , as Co-Trustees (the "Trustee"), If one of the above nominees does not serve for any reason, with bond. without bond. with bond. without bond. If such person or entity does not serve for any reason, I nominate with bond. without bond. with bond. without bond. the remaining nominee shall serve as sole Successor Trustee, I nominate , of , , to be the replacement Co-Successor Trustee, If such person or entity does not serve for any reason, I nominate with bond.without bond.with bond.without bond.

is designated as the successor Trustee and , of , are designated as successor Co-Trustees (the "Trustee"). Accounting. The Trustee shall provide an accounting to the Beneficiary (or Beneficiaries) on at least a(n) basis. If a beneficiary has a "disability", the Trustee shall provide the accounting to a guardian or conservator of the beneficiary, if any.

without bond. with bond except that no bond shall be required of any qualified successor corporate Trustee. with bond. , with the following requests:.

. that they take possession of and care for all my animals and search for good homes for them

. that until homes are found for my animals, the animals be placed in foster homes rather than in cages at the shelter

. that if it is necessary to keep some of the animals in cages while making arrangements to fend permanent homes, in no event should any animal stay more than a total of 2 weeks in a cage

. that each animal should receive appropriate veterinary care, as needed

. that after attempts have been made for 3 months to place an animal, that , presently residing at , , , be contacted if it is not possible to place an animal so that he can assist with finding a home for the animal

. that the shelter make every effort to assure that none of my animals are ever used for medical research or product testing or painful experimentation under any circumstances

. that, after placement, shelter personnel make follow-up visits to assure that my animals are receiving proper care in their new homes

. that they take possession of and care for all my animals for the remainder of the animals' lives

.

If is in existence at the time of my death and is able to accept my animals, I give to . and

ARTICLE

NOMINATION OF

I nominate , of , , Dependent Independent to serve as my , and , of , , as Co-s (the ""), to serve with bond. to serve without bond, surety, or other security. If one of the above nominees does not serve for any reason, the remaining nominee shall serve as sole If one (or both) of the above nominees does not serve for any reason, I nominate , of , , as replacement Co- (or sole ), to serve with bond. to serve without bond, surety, or other security.

ARTICLE

Independent shall have all powers and authority granted by law or necessary or appropriate for proper administration. in addition to other powers and authority granted by law or necessary or appropriate for proper administration, shall have the following rights, powers, and authority without order of court and without notice to anyone: to identify, gather, value, secure, manage and distribute assets, to maintain records, to settle and wind up business affairs, to pay just debts, to file necessary tax returns, to redirect mail, to cancel services, to establish trusts, and to carry out my wishes as set forth in this Will.

. Hold Trust Assets as a Single Fund. To hold the assets of the trust, shares, or portions of the trust created by this instrument as a single fund for joint investment and management, without the need for physical segregation, dividing the income proportionately among them. Segregation of the various trust shares need only be made on the books of the Trustee for accounting purposes.

. Compensation. To receive reasonable compensation for their services under this Will and be exonerated from and to pay all reasonable expenses and charges of the estate and trust.

. Loans to Beneficiaries. To make loans to any trust beneficiary for the purpose of providing the beneficiary with the funds necessary to take advantage of exceptional business opportunities or to provide for the needs of the beneficiaries and their families.

. Methods of Distribution. To make payments to or for the benefit of any beneficiary (specifically including any beneficiary under any legal disability) in any of the following ways: (a) directly to the beneficiary; (b) directly for the maintenance, welfare and education of the beneficiary; (c) to the legal or natural guardian of the beneficiary; or (d) to anyone who at the time shall have custody and care of the person of the beneficiary. The or Trustee shall not be obliged to see to the application of the funds so paid, but the receipt of the person to whom the funds were paid shall be full acquittance of the or Trustee.

. Independent Administration. My shall have the right to administer my estate using "informal", "unsupervised", or "independent" probate or equivalent legislation designed to operate without unnecessary intervention by the probate court.

. Compensation. Receive reasonable compensation for their services under this Will and be exonerated from and to pay all reasonable expenses and charges of the estate.

ARTICLE

MISCELLANEOUS PROVISIONS

. Paragraph Titles and Gender. The titles given to the paragraphs of this Will are inserted for reference purposes only and are not to be considered as forming a part of this Will in interpreting its provisions. All words used in this Will in any gender shall extend to and include all genders, and any singular words shall include the plural expression, and vice versa, specifically including "child" and "children", when the context or facts so require, and any pronouns shall be taken to refer to the person or persons intended regardless of gender or number.

predeceased my spouse, and notwithstanding any other provision of this Will, my spouse (or my spouse's estate as the case may be) shall receive the distribution to which my spouse would otherwise be entitled to receive without regard to a survivorship requirement, if any.survived the death of my spouse.Independent

IN WITNESS WHEREOF, I have subscribed my name below, this _____ day of _____________________, _______.

| Testator Signature: | ___________________________________ |

and in the sight and presence of each other,

STATE OF COMMONWEALTH OF ; and subscribed and sworn to before me by and , witnesses

Name of Sole Digital Executor: , City: , State:

Name of Co-Digital Executor: , City: , State:

Name of Co-Digital Executor: , City: , State:

should initial on the bottom margin of each page of the Will. This is done to prevent the substitution of pages. must sign each page of the Will, as required by the Louisiana Civil Code, Article 1577. must sign the pages in the presence of a notary public and at least two competent witnesses.

The Self-Proving Affidavit

The self-proving affidavit ("Proof of Will" in some states) is a document which should be signed in front of a notary public and attached to the end of the Will. The affidavit recites that the requisite formalities were observed in signing the Will.

Although attaching the affidavit has nothing to do with the legality of the Will itself, it can speed the admission of the Will to probate after the death of the Will writer because it eliminates the need to have a witness appear at the probate proceeding to testify that the formalities in signing the Will were followed. The witnesses may not be available later when they are needed. A self-proved Will may be admitted to probate without additional witnesses or affidavits, but it is still subject to contest on such grounds as undue influence, lack of testamentary capacity, or prior revocation.

three two or a notary public. and a notary public. . In California, witnesses to a will are not required to be disinterested, but if they are "interested", there is a rebuttable presumption that the witness received the will's benefit through fraud or other undue influence, unless there are two additional disinterested witnesses. If the interested witness can not rebut that presumption, they can not take more than they would have taken if no will had existed at all, if anything. The signature of an interested witness will count towards satisfying California's requirement that non-handwritten wills have two witnesses. . Many states require only two witnesses, but the signature of a third witness provides some protection against the possibility that one of the witness' signatures will be invalid for some reason. For example, a person should not be a witness if that person is a beneficiary under the Will. In most states, if a beneficiary's signature is counted in order to satisfy the minimum number of witnesses, then the Will is not necessarily invalidated, but that "interested witness" may not receive a share of the estate any larger than if the Will writer had died without a will. . Vermont requires three witnesses. The signature of a third witness provides some protection against the possibility that one of the witness' signature will be invalid for some reason. For example, a person should not be a witness if that person is a beneficiary under the Will. In most states, if a beneficiary's signature is counted in order to satisfy the minimum number of witnesses, then the Will is not necessarily invalidated, but that "interested witness" may not receive a share of the estate any larger than if the Will writer had died without a will.

About Last Wills and Testaments

Learn how to set out your wishes for assets and guardianship

-

Requirements for Writing a Will

Anyone of legal age and sound mind can make a last will and testament. Legal age varies by state:

- In 48 states, a will-maker must be at least 18 years of age.

- In Louisiana, you can make a will at 16.

- In Georgia, you can make a will as early as 14.

- Many states make provisions allowing those younger than 18 to write a last will if they are married, economically independent, or a member of the armed forces.

Mental competence is an essential factor in making sure your will is legally binding. Being mentally competent means that you know you are executing a last will, and are familiar with your property as well as your family and descendants; the famous line from movies is “being of sound mind and body”.

Witnesses are also required to sign the last will, and one of their functions is to validate your mental well-being.If you anticipate that the will might be contested based on mental incompetency, take extra steps like getting a doctor’s assessment at the time of the signing of the last will.

-

Property to include in your Will

Your estate is composed of your assets at the time of your death. Your assets may include the following:

Joint Property

Most states permit an individual to own property with another individual in a manner known as "joint with rights of survivorship." In such a case, when the first joint owner dies, the property passes to the second joint owner, even if the first owner attempted to give the property to a third person through his or her Will.On the other hand, if an individual owns property with another person "joint with rights of survivorship" and wants the property to pass to a third person under the Will, a lawyer should be consulted.

Personal Property

Personal property is either tangible or intangible.Tangible personal property includes jewelry, furniture, cars, and other items that have a physical essence. Intangible personal property includes cash accounts, stocks, bonds, and other similar assets that are nonphysical.

A coin is tangible personal property, while 25 cents in a checking account is intangible personal property.

Life Insurance/Annuity/Pension Plan Designations

Life insurance, annuity, and pension plan agreements (and similar agreements) permit an individual to name those who will receive the proceeds of such agreements either as primary or alternate beneficiaries.Your Will does NOT determine the beneficiary (recipient) of the proceeds of any of these agreements. Rather, the designations filed with the insurance company control the distribution of the proceeds of these agreements. Similarly, IRA accounts allow the owner to designate a beneficiary who will receive the proceeds of the account upon the death of the owner of the account.

Thus, after any drafting of a Will, you should review the agreements to make sure that the beneficiary designations of such agreements correspond to your wishes as set forth in the Will.

-

Choosing beneficiaries

The primary purpose for having a last will and testament is to specify the persons, called “beneficiaries”, who will receive your property after your death. Often the beneficiaries are family members and friends. They can also be charitable organizations or trusts.

Your last will does not control the distribution of your life insurance, retirement plans, and trusts—basically, the types of assets that are paid in accordance with beneficiary designation forms, unless your designations of the life insurance proceeds are specifically designed to cause the proceeds to flow through your last will.

If you don’t have a will, state law controls who will receive your property. Generally, this means that your property will go to your heirs and spouse (if you have one).

Depending on your circumstances, state law would probably require that your property be distributed to the following people:

- Spouse. Your spouse is most likely the first beneficiary designated in a last will. In most states, it’s actually against the law to try to disinherit your spouse upon your death. You may wish to leave everything to your spouse, but you should also consider how well your spouse can manage finances, or provide for other dependents.

- Children. While it’s common to leave your assets to your spouse with the expectation that they’ll provide for your children, you may wish to create special provisions for your children, in case something happens to your spouse. This is especially true if you or your spouse have children from another marriage.

- Other Family Members. In some cases it may be desirable to provide for siblings and elderly parents. In other cases, nieces and nephews may be appropriate choices.

- Friends. Friends, particularly close friends, may be more important to you than family members, and can be appropriate beneficiary choices.

- Charities. Charitable organizations provide important services, and many depend on gifts from estates as an important funding source. Leaving a bequest to one or more appropriate charities can help provide important services and benefits to your community and/or promote values that are important to you, and certainly are appropriate beneficiary choices. In addition, tax laws encourage charitable gifting, and as a result, significant income tax and estate tax savings can be achieved through charitable gifting.

- Contingent Beneficiaries. You should provide for the possibility that your first choice as a beneficiary will not survive you. You can name a contingent beneficiary to receive your assets in the event your first choice is unable to accept your bequest. You should provide for enough layers of contingent beneficiaries to reasonably assure yourself that beneficiaries will be available to receive the assets of your estate.

-

Disinheriting People

Disinheriting means depriving another person (an heir or spouse) of property that would have been distributed to that person under the laws of intestacy (dying without a valid Will).

It is the general practice for a Will writer to provide for distributions to the Will writer's family, particularly the Will writer's spouse (if married) and children (if any), or in the case of a deceased child, such child's children (if any). Such persons are said to be "the natural objects of the Will writer's bounty."

If such persons exist but are not included in the Will, a question may arise as to whether you as the Will writer simply made a mistake. Further, such excluded persons may attempt to challenge the Will under the assumption that you simply made an error in excluding them from the Will.

If you intend to exclude someone that might expect to be included in the Will, it is advisable to include a statement in the Will that makes it clear that the omission was intentional. Although this type of exclusion generally applies only to individuals, this provision can also be used to list organizations that will be excluded.

-

Types of bequests

Gifts made at the time of death (whether through a last will and testament or a living trust) are made as specific bequests or residuary bequests.

Specific Bequests: A specific bequest is a gift (bequest) or a specific item or asset to a named person or entity. For example, specifically providing that your diamond ring shall be given to your daughter is a specific bequest. Or, you may specifically provide that $1,000 shall be distributed to each of your five grandchildren. Specific bequests are usually made at the beginning of a last will or living trust, followed by other provisions that provide for the distribution of the other assets of your estate.

Residuary Bequests: A residuary bequest is a gift (bequest) of all or a portion of the remaining assets after making distributions of specific bequests. Specifically providing that all of your remaining property shall be distributed in equal shares to your daughter and your favorite charity is an example of two residuary bequests.

-

Choosing executors

An "Executor" or "Personal Representative" is the person or organization named in a Will who has the responsibility of carrying out the terms of the Will. Those responsibilities are to collect your assets, pay the debts and expenses of the estate, and distribute the remaining assets to the beneficiaries. The independent executor may be a beneficiary under the will.

Some states use the term "Personal Representative," rather than "Executor," but generally, either term is acceptable. If you have no preference, use the term "Executor."

The Executor's responsibilities are significant. Therefore, the person or organization should be trustworthy and capable of handling financial matters. A business background may be helpful, but certainly is not required. If the Executor will be working with a capable lawyer, the Executor's responsibilities will be much easier to handle.

Many banks have trust operations that provide executor services, but of course, the bank will charge for its services.

If an individual will be selected as the Executor, that person should be a resident of the same state as you. Some states disqualify nonresident individuals entirely and other states allow nonresident individuals only under certain conditions. If you want to select a nonresident Executor, you can find out what your state allows by contacting your county clerk of probate court or an attorney.

It is recommended that you select an Alternate Executor who will serve if the first choice is unavailable or unwilling to serve. You may name an Alternate to serve alone or name Alternate Co-Executors to serve together. If one of the Alternate Co-Executors is unable or unwilling to serve, the remaining Co-Executor will serve as sole Executor. You may also list another name so that there will still be two Alternate Co-Executors if you wish.

-

Signing and witnessing a Will

Your last will and testament is not valid until the signing and witnessing requirements have been met. You must be mentally competent when you sign the Will, and in most states, you must meet a minimum age requirement of at least 18 years old.

Your signature to your last will must be witnessed by two other persons who are also required to sign the will. Some states have restrictions on who can serve as witnesses. In many states, a witness cannot be a beneficiary of the estate. States have adopted these laws to prevent any conflict of interest from those who may be in line for gifts, or who may benefit from your death. Some states will allow for a beneficiary to act as a witness, but in doing so, that witness may lose some or all of the property that he or she would have inherited. Some states also place restrictions on whether or not your designated executor can act as a witness, so again, it's important to check with your state.

If you think your last will might be contested by your heirs, you may need to get a doctor's note to prove that you were of sound mind when you wrote and signed your will. This will reduce the chances of your last will being overturned in probate court.

In most states, your signature and the signatures of the witnesses need to be notarized.

Last Will and Testament FAQs

-

How do I write a Will online for free?

It's very easy to set forth your wishes with a free Last Will and Testament template from Rocket Lawyer:

- Make your Will - Answer a few questions, and we will do the rest

- Send or share - Review the document with a lawyer, if needed

- Sign it - Mandatory or not, having two disinterested witnesses is a best practice

This method, in most cases, will end up being notably less expensive and less time-consuming than meeting and hiring your average attorney. If needed, you may fill out this Last Will and Testament on behalf of a relative, and then help them sign once you've drafted it. Please keep in mind that for this document to be accepted as legally valid, the testator must be an adult who is mentally competent at the time of signing. If the testator has already been declared legally incompetent, a conservatorship could be required. When dealing with such a situation, it would be a good idea for you to connect with a lawyer.

-

Why should I make a Will?

Every person over 18 should have a Last Will and Testament in place. While it is difficult to think about, your loved ones will want to know your wishes for guardianship (when applicable), your property, and/or assets when you pass away. Here are a few typical occasions in which it may be helpful to make or update your Will:

- You have a new biological or adopted child.

- You are newly married or divorced.

- You own a home or other property.

- You are aging or dealing with ongoing health issues.

Regardless of whether this Last Will and Testament has been created in response to a change in your life or as part of a forward-looking plan, witnesses and notarization are highly encouraged for protecting your document if its validity is questioned.

-

Should I work with an attorney for my Will?

Rocket Lawyer makes it easy to create a highly customized and legally binding Will. Different from many other template websites, Rocket Lawyer offers more than a basic template to make your Last Will and Testament, with interview questions that guide you through the journey and help you build a customized Will.

Even with Rocket Lawyer, complicated estates or beneficiary situations might still necessitate legal advice from an estate lawyer. If you or your executor have questions, rely on Rocket Lawyer. You can have a lawyer review your Will or ask specific legal questions, and if you have estate planning needs that call for more than a simple answer, Rocket Lawyer can also help you find and connect with a licensed attorney to help you with all your estate planning. Premium members can receive up to a 40% discount when they connect with a Rocket Lawyer network attorney.

-

How much does it cost to make a Will?

The average cost of working with a lawyer to write a Last Will and Testament might range between $200 and $1,000, depending on where you are located. With Rocket Lawyer, it is included in your membership.

-

Does a Last Will and Testament need to be notarized or witnessed?

The requirements will vary by state; however, it is strongly recommended to have your Will signed by two disinterested witnesses and notarized to reinforce the credibility of the document.

-

Does a Last Will and Testament need to be filed?

A Will does not have to be filed with the county until the testator passes away. Filing the document (alongside any specific forms required by the county) initiates the probate process.

-

Which is better, a will or a trust?

Both a Last Will and Testament and a Living Trust possess advantages and disadvantages, although the one you choose will depend on your goals and where you are in your life. To determine whether to use a will or a trust, you must understand the key differences between these two estate planning devices.

A will:

- Does not take effect until you die.

- Covers any property that is only in your name when you die.

- Allows you to name a guardian for children and to specify funeral arrangements.

- Passes through probate.

- Is public record and any transactions are also public record.

A trust:

- Takes effect once created -- if you fall ill or become incapacitated your trustee can control your estate.

- Only covers property that has been transferred into the trust.

- Passes outside of probate, saving time and costs of probate.

- Can be used to plan for disability or to provide savings on taxes.

- Has an added benefit of privacy, as trusts are not public record.

Generally, neither one is "better" than the other. It simply depends on your specific preferences and circumstances. You can also make both to accommodate separate needs.

-

What makes a will invalid?

A will can be considered invalid by your state for a number of reasons, including (but not limited to) the following:

Mental incompetence

Most states typically require that the person making the will is mentally competent during the time of creation. The competency standard can be met in many states if you possess an understanding of the following:- The property you own.

- Who your relatives are.

- What the will says and means.

- Your relationship with the beneficiaries you have designated.

In other states, there is additional guidance around mental illness. For example, in California, an individual with hallucinations or delusions resulting from a mental illness may not be considered to have the capacity to make a valid will, if their decision-making with regard to the will and the distribution of their property is impacted. If you have questions about making a legally valid will, ask a lawyer.

Previous wills

To avoid confusion and ensure that the most recent will is followed, it is important to destroy every copy of any previous, outdated will. That said, it is possible to have multiple valid wills for dealing with property in multiple states, if one will is a supplement to another, or for other limited reasons.Improper witnesses

Many states require that a will be witnessed by at least two people over the age of 18. Witnesses will observe the signing of the will and confirm mental competence at the time of the signing.If you need more guidance before getting started on your Last Will and Testament, ask a lawyer or check out more estate planning documents.

Our quality guarantee

We guarantee our service is safe and secure, and that properly executed Rocket Lawyer legal documents are legally enforceable under applicable US laws.

Need help? No problem!

Ask a question for free or get affordable legal advice when you connect with a Rocket Lawyer network attorney.

Last Will and Testament checklist

Complete your free Last Will and Testament with our Make it Legal™ checklist

Learn more about Wills in your state

Choose the state where you live

Pick a state:

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- District of Columbia

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming