MAKE YOUR FREE Partnership Agreement

What we’ll cover

What is a Partnership Agreement?

When can you use a Partnership Agreement?

- You are ready to form a Partnership and you want to define the business terms of the Partnership.

- Someone else has asked to partner with you or your business.

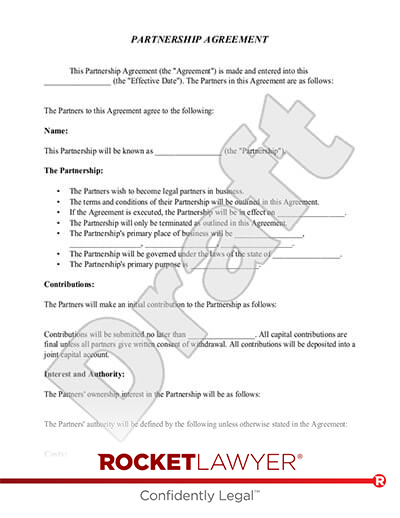

Sample Partnership Agreement

The terms in your document will update based on the information you provide

PARTNERSHIP AGREEMENT

This Partnership Agreement (the "Agreement") is made and entered into this (the "Effective Date"). The Partners in this Agreement are as follows:

| Partner Name |

| Address |

| City | State |

| ZIP Code |

The Partners to this Agreement agree to the following:

. NAME

This Partnership will be known as (the "Partnership").

. THE PARTNERSHIP

| The Partners wish to become legal partners in business. |

| The terms and conditions of their Partnership will be outlined in this Agreement. |

| If the Agreement is executed, the Partnership will be in effect on . |

| The Partnership will only be terminated as outlined in this Agreement. |

| The Partnership's primary place of business will be , , , . |

| The Partnership will be governed under the laws of the state of . |

| The Partnership's primary purpose is . |

| If applicable, the Partners will obtain any necessary licenses and permits to do business, register its Doing Business As Name ("DBA"), and obtain a Federal Employer Identification Number ("EIN"). |

. CONTRIBUTIONS

The Partners will make an initial contribution to the Partnership as follows:

| : |

Contributions will be submitted no later than . All capital contributions are final unless all partners give written consent of withdrawal. All contributions will be deposited into a joint capital account.

. INTEREST AND AUTHORITY

The Partners' ownership interest in the Partnership will be as follows:

| : % |

The Partners' authority will be defined by the following unless otherwise stated in the Agreement:

The Partnership has chosen an entity to act as the Partnership Representative, and thus has elected as the "Designated Individual".

. COSTS

The Partners will share costs according to the following percentages:

| : |

. PROFITS

The Partners will share the net profits of the Partnership according to the following percentages:

| : |

The Profits will be accounted by and distributed on the of the month according to the above percentages after the costs of the Partnership have been paid according to the above cost percentages.

. SALARY

All Partners must give their unanimous consent if a permanent salary is to be established and their unanimous consent for the amount of salary to be given to each Partner.

| Management Roles: |

| Work Hours: Each partner agrees to work hours per week, excluding vacation weeks or weeks with a federal holiday. |

. ACCOUNTING

| All accounts related to the Partnership including contribution and distribution accounts will be audited |

| All Partners will maintain a joint contribution account. All Partners will maintain distribution account. Partners will keep accurate and complete books of account for all accounts related to the Partnership. Any Partner, whether majority or minority, will be allowed to review all books of account at any time they request. |

| Each Partner will be responsible for his or her own taxes on any distributions made. |

| Accounting records will be kept on a |

| The fiscal year will be complete on the last day of of each year. All Partners will present their position on the state of the Partnership within two weeks of the completion of each fiscal year. |

. NEW PARTNERS

The Partnership will amend this agreement to include new partners upon the written and unanimous vote of all Partners.

The name of the Partnership may be amended if a new Partner is added to the Partnership upon the written and unanimous vote of all Partners.

. WITHDRAWAL OR DEATH

The Partners hereby reserve the right to withdraw from the Partnership at any time. Should a Partner withdraw from the Partnership because of choice or death, the remaining Partners will have the option to buy out the remaining shares of the Partnership. Should the Partners agree to buy out the shares, the shares will be bought in equal amounts by all Partners. The Partners agree to hire an outside firm to assess the value of the remaining shares. Only upon the partners' unanimous agreement will the outside firm's valuation of the shares be considered final. The Partners will have days to decide if they want to buy the remaining shares together and disperse them equally. If all Partners do not agree to buy the shares, individual Partners will then have the right to buy the shares individually. If more than one Partner requests to buy the remaining shares, the shares will be split equally among those Partners wishing to purchase the shares. Should all Partners agree by unanimous vote, the Partnership may choose to allow a non-Partner to buy the shares thereby replacing the previous Partner.

If no individual Partner(s) finalize a purchase agreement by days, the Partnership will be dissolved.

The name of the Partnership may be amended upon the written and unanimous vote of all Partners if a Partner is successfully bought out.

. DISSOLUTION

Should the Partnership be dissolved by vote, the Partnership will be liquidated, and the debts will be paid. All remaining funds after debts have been paid will be distributed based on the percentage of ownership interest outlined in this Agreement.

. AMENDMENTS

| Amendments may be made hereto upon the unanimous and written consent of all Partners. |

| Amendments must be expressly written and have the original signatures of all Partners. |

| All amendments, notices, requests, claims, demands and other communications between the parties shall be in writing. All such written communications shall be given (i) by delivery in person, (ii) by a nationally recognized next day courier service, (iii) by first class, registered or certified mail, postage prepaid, (iv) by facsimile or (v) by electronic mail to the addresses of the parties specified in this Agreement or such other addresses specified in writing. All notices shall be effective upon (i) receipt by the party to which the written communication is given, or (ii) on the 5th day following mailing, whichever occurs first. |

Any controversies or disputes arising out of or relating to the Partnership or this Agreement will be submitted to mediation in accordance with any statutory rules of mediation in the state of . If mediation does not successfully resolve the dispute or is unavailable, the parties may proceed to seek an alternative form of resolution in accordance with any other rights and remedies afforded to them by law.

IN WITNESS WHEREOF, this Agreement has been executed and delivered in the manner prescribed by law as of the Effective Date first written above.

| By: | Date: |

About Partnership Agreements

Learn how to set expectations for a business partnership

-

How To Write a Partnership Agreement

A Partnership Agreement may be used to outline the terms of a new business partnership. It typically includes a list of all Partners to the agreement, as well as their contribution amounts, ownership interest percentages, cost share, and profit share.

The terms of authority, accounting obligations, and buy-out options may also be included in a Partnership Agreement. In addition, partners may want to define management roles, required work hours, and vacation time. Let’s go over some of the essential parts of a Partnership Agreement in more detail.

Contributions

The contributions section of a Partnership Agreement template sets out what each partner is contributing to the partnership. Each partner will often put something into the partnership to establish it. While contributions are not technically required, they are often a good idea.

First, they show that each partner is invested in the venture—they have literally put an investment into the success of the business. Second, an initial investment also provides legitimacy to the business. Having separate assets for the partnership allows it to function as a standalone business, rather than just as an extension of a few individuals or entities.

Contributions can take many forms, but money and tangible assets are the most common. If a partner contributes funds, those are easy to list out and track. Assets are a bit harder because the partnership should associate a dollar value with the asset. This step is especially important in partnerships where the ownership, distributions, or salaries from the venture are based on a percentage of the initial investment.

Each contributed asset also needs a dollar value assigned to it for tax purposes. This initial dollar value is usually the tax basis. The basis will often be adjusted for depreciation as time goes on, and when the partnership goes to sell the asset, both of these dollar figures will have tax consequences. Talk to a tax advisor for full information about this more complicated aspect of starting a partnership with hard assets such as real estate.

Interest and Authority

The interest and authority section of the Partnership Agreement template describes each partner’s ownership interest in the business venture. Generally, an ownership interest is expressed as a percentage. Partners can choose how much each partner will own.

As an example, some Partnership Agreements base ownership on the amount of investment into the business. If each partner contributed half of the capital, they would take half of the ownership. If they contribute 60% of the capital, they will own 60% of the partnership.

Others will divide interest based on the anticipated contribution to the partnership. For instance, if one partner is more “active” and the other contributed capital to get the business going, the partnership might choose to vary the ownership percentages based on the relative importance of both of these roles.

The “authority” portion of this section will also set out how voting and management will function. Ownership and authority often go hand in hand—partners with more ownership interest will often have more authority, but not always. Partners could also choose to give everyone an equal vote regardless of ownership percentage.

Partners can be creative and craft an interest and authority scheme that works for them. Many choose to have just one or two partners act as “managing partners” or “designated individuals.” These people (or entities) have the authority to make binding decisions on behalf of the partnership, with or without consultation with the other partners.

Costs

The costs section simply sets out who will be responsible for the costs. In most cases, partners will share in the costs equally or based on the amount of ownership they have. Again, partners can craft a cost-sharing scheme that works for their unique situation.

Profits

The profits section will describe how profits from the business venture will be divided. These can be equally divided, divided up based on ownership percentages, or divided by any other scheme that the partnership decides.

This section can also address who accounts for the profits and what is considered a “profit.” In most cases, a profit is the amount left over after all costs have been addressed, but not always.

This section should also set out how profits are paid, including when payments should be made and who makes those payments.

Salary

Not every Partnership Agreement will include a separate salary for partners. However, if one or more partners want a set salary, the partnership can include a section about this issue as part of their agreement.

In many situations, if a partnership is just starting, this section will simply state that salaries can be developed in the future. It will also describe how future salaries must be approved (such as by a voting percentage). Then, once the business gets going, the partners revisit this section to set specific salary amounts that will be sustainable for the company.

If the partnership already has a good idea of what kind of profits will be available, they can immediately set a salary and include it in their Partnership Agreement. However, if the partnership takes this type of step, they might also want to include language about what will happen if the business venture cannot pay a specific salary or how industry downturns will be addressed.

Partner Roles

Many Partnership Agreements specifically set out how partners will contribute to the venture. Having this type of discussion and agreement at the outset can address a lot of areas of potential concern in the future, especially when it comes to sharing workloads to make the business thrive.

As an example, the partnership can agree that each partner will work a specific number of hours per week or per month. They might set out specific working hours (like 9 am to 5 pm) or provide a certain number of vacation days. This section might also address emergency situations, such as when a partner cannot work because of a severe illness or accident.

Like many of the other sections, establishing partner roles is flexible. In most situations, the partners can develop a schedule and rules that work for them individually and as part of their specific industry or type of business. Of course, partners can often leave out this section entirely if they want to do that as well.

Accounting

The accounting section sets out how the partnership will keep its books and records. This section often includes things like:

- Whether the partnership will be cash basis or accrual basis when it comes to taxes and accounting records.

- How often the books and records will be audited.

- Where the accounting information will be kept.

- Who will maintain the accounting information.

- How bank accounts or investment accounts will be maintained.

- Who the partnership will hire to do its taxes or otherwise address individual partner taxes.

- When the fiscal year will be (based on the calendar year or some other time period).

- Who can sign checks and authorize payments to third parties.

- The process of reviewing books and records when any partner makes a request.

Keeping accurate accounting records is critical for any business. However, it is especially important for partnerships that have several people involved. Knowing who is doing what and putting processes and procedures in place at the outset of the business can address a lot of potential conflicts before they arise.

New Partners

The new partners section sets out how new partners can be added. In most partnerships, a new partner can only be added by a majority or unanimous consent from the other partners. This section might include a description of the voting process, any buy-in requirements, or other information for new partners.

Some partnerships are named after the partners. In that case, this section might also address whether a name change is required when the group adds a new partner.

Withdrawal or Death

Every Partnership Agreement should include a section that addresses circumstances where a partner wants to withdraw from the partnership or passes away. The withdrawal process will usually involve notification methods and a process for their partners to purchase the ownership of the withdrawing partner.

The section that addresses the death of a partner will usually describe how the other partners can purchase or otherwise obtain partnership units from heirs or anyone else that might acquire the deceased partner’s ownership.

Many Partnership Agreement templates also set out that if partnership ownership units are not purchased within a certain amount of time, then the partnership must dissolve.

Dissolution

Dissolution refers to ending the partnership altogether. This section will usually set out the process for dissolution, including how a dissolution determination is made, such as by vote. In most cases, a partnership can only be dissolved if there is a unanimous decision of all of the partners, but not always. Partners can choose the type of vote necessary for dissolution.

This section also often sets out specific triggering events that will lead to dissolution. Examples of triggering events might include:

- Death or disability of a partner.

- Lack of other partners’ desire to purchase a leaving partner’s ownership.

- Debts cannot be paid as they become due.

- A court determines that it must be dissolved for any reason.

Many state laws will have default dissolution proceedings that you may need to consider when drafting a partnership agreement.

Amendments

The Partnership Agreement will also set out specific instructions on how to amend or change the agreement. In most cases, amendments must be in writing, and the majority of the partners must agree to the amendment. Many agreements will require that each partner sign off on the amendment in writing as well.

Dispute Resolution

Dispute resolution refers to any method that is not litigation to resolve a dispute between the members of the partnership. Some of the most common dispute-resolution methods include:

- In-person meetings and required informal discussions.

- Mediation.

- Arbitration.

You can also informally choose a third party to make decisions if there is a dispute between partners on a specific subject.

Creating an agreement for dispute resolution can often help cut down on costs associated with internal disputes because the partners must use this method before they can simply start litigation. It can help partners who have an issue with one or more partners resolve matters before involving third parties.

-

Definitions of Partnership Agreement Terms

Term Definition Accrual basis accounting An accounting method where income is credited when it is earned (instead of when you receive the funds) and expenses are debited when they are incurred (instead of when they are paid). Cash basis accounting An accounting method where income and expenses are only tracked when they come in the door or leave the account. Dissolution The closing down or winding up of a business, often involving paying outstanding debts, liquidating assets, and paying any remaining equity in the business to individual owners.

Partnership Agreement FAQs

-

What should a Partnership Agreement include?

It's easy to write a Partnership Agreement using Rocket Lawyer. Just answer a few simple questions and Rocket Lawyer will build your customized contract. As a Rocket Lawyer Premium member, you can access, copy, edit, and email your Partnership Agreement directly from your account. Your document can also be electronically signed or downloaded in PDF or Word format.

Here are some examples of information that your Partnership Agreement should include:

Contact information

- Contact information for the person organizing the partnership

- Contact information for the business itself

Business details

- Legal name for the partnership as well as the trade or business name if you have one

- Description of what the business does

- What date your business will begin operation

- How many employees you expect to have

- Expected revenue

- End date, if applicable

Partner and personnel details

- Percentage of ownership for each partner

- Partner contributions

- How a partner can leave the company

- What happens if a partner dies

- Non-compete requirements

- Non-partner employee details

Tax responsibilities

- Who will be responsible for tax matters

- When your fiscal year will ends

Voting rights

- How voting rights will be distributed

- How much of a vote is required to make business decisions

A Partnership Agreement can create significant legal obligations for each partner. With that in mind, it is important to review the document to make sure you agree with all of the details, duties, and procedures specified. A lawyer can help to answer any questions.

-

Why is a Partnership Agreement important?

A Business Partnership Agreement helps to outline the terms of a new business partnership. Without a Partnership Agreement in place, partners may find themselves in disagreement about how to run the business. A written Partnership Agreement that outlines basic business practices can help to alleviate future conflicts before they start.

A Partnership Agreement can help you outline the terms of your new business relationship. You will be able to list all partners to the agreement as well as their contribution amounts, ownership interest percentages, cost share, profit share, and responsibilities. This contract can help you outline the terms of your business engagement, how the business will be run, and ultimately how the partnership may dissolve.

If you are ready to go into business with one or more partners, it may be time to make a Partnership Agreement. If you have questions about forming a business partnership, ask a lawyer.

Our quality guarantee

We guarantee our service is safe and secure, and that properly executed Rocket Lawyer legal documents are legally enforceable under applicable US laws.

Need help? No problem!

Ask a question for free or get affordable legal advice when you connect with a Rocket Lawyer network attorney.